December 2025

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN

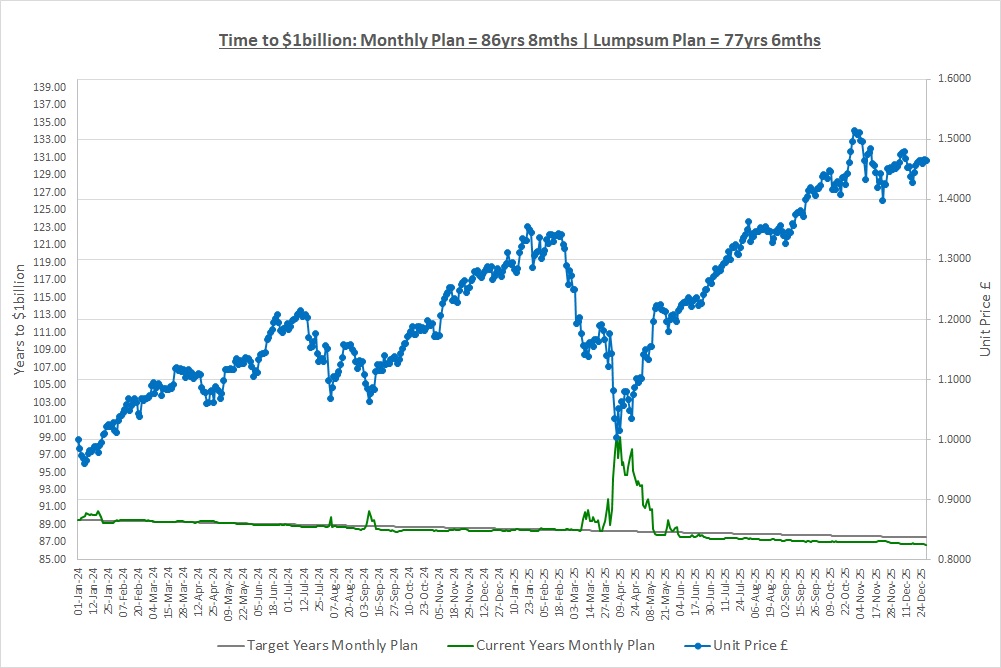

Our Lumpsum Plan will be worth $1billion in: 77yrs 6mths

Our Monthly Plan will be worth $1billion in: 86yrs 8mths

Please subscribe for free to receive our posts by email using the Subscribe box at the top of our website.

Happy New Year and welcome to The Crazy Plan’s third year! Last month we pulled our plan together into five key areas: Save; Invest; Build a Portfolio; Manage the Psychology of Investing; and Look to Improve. We said that saving will probably not make us wealthier but it provides the capital to invest, it’s investing in the stock market that’s historically built wealth. If we do this by building a portfolio of investments we diversify our risk which helps avoid costly mistakes on a single investment. We looked at some psychological challenges such as resisting the temptation to spend and the volatility we have to ride and these challenges are perhaps the hardest part of building wealth. Finally, we said that we must constantly look to improve and that’s what we’ll start to do in future posts. We also revisited the table of wealth which showed that we’re on a journey, it’s not just about the destination of $1 billion.

This month we’re going to pull out some important lessons from the last year to consolidate what we’ve covered but first we’ll have a look at our performance.

RESULTS FOR THE YEAR

Our performance for 2025 was as follows:

Monthly Plan: Value = $1,835 (£1,363), Years to $1billion = 86yrs 8mths

Lumpsum Plan: Value = $19,734 (£14,649), Years to $1billion = 77yrs 6mths

The Crazy Fund: 1yr return = +14.5%

The Crazy Fund: CAGR since inception = +21.0%

It was another great year for The Crazy Fund with our investments returning 14.5% which took our CAGR since inception to 21%. This is way above our expectations and we expect it to drift lower over the coming years. Although our return was good, it was a volatile year and we saw our first big drawdown of (26%) back in April. This is a sizeable drawdown if you look at where it sits in the table of drawdowns back in post “2.8 Stock Market Volatility: Drawdowns” but thankfully it didn’t last too long, only 132 trading days.

The FX rate to see how much we’re worth in USD moved by 7.6% in our favour, from $1.3240 per £1 to $1.3471 which reduced how long it will take us to reach $1 billion. How? At the beginning of the year, we needed £755,287,009 to be worth $1 billion ($1 billion / $1.3240) but at the end of the year we only needed £742,335,387 ($1 billion / $1.3471). If we need less that means we’ll get there quicker.

Slowly but surely the Monthly Plan is building wealth and this is only happening because we are disciplined in saving £50 a month. If we started to skip some months or save less then bad money-habits would creep back in and our chances of becoming wealthy would evaporate.

Additionally, both plans are showing how long-term thinking pays off. We were tested by our first large drawdown this year and if we had thrown in the towel we would not have ended up 14.5% for the year. Our CAGR of 21% over the last couple of years is the result of taking a long-term approach and accepting the volatility that comes with investing.

Lesson #1: Building wealth is a long-term mission. Discipline is key and there are no shortcuts.

KEY LESSONS FROM OUR POSTS

We started off the year by rebalancing our portfolio as detailed in post “2.1 Rebalancing a Portfolio.” Periodically rebalancing back to equal weights is just as important for a portfolio of funds as it is for one of single stocks. The same problem of suffering a large loss from a single investment will arise when investing in funds if we let a single investment dominate the portfolio. We don’t need to get to perfect weights, just close to equal weights to keep our single investment exposure down.

Lesson #2: Rebalancing our portfolio periodically back to equal weights maintains diversification which is key to avoiding a large loss from a single investment.

We then moved on to look at funds in posts “2.2 Funds: Unit Trusts / Mutual Funds” and “2.3 Funds: ETFs & Investment Trusts.” Our investment strategy is to employ professionals and use index investing and both of these can be achieved using funds. We looked at three types of funds: Unit Trusts / Mutual Funds; ETFs; and Investment Trusts. Funds are really simple, we invest our money in them and it’s pooled with money from other investors and the managers invest it on our behalf. Investing in funds also diversifies our risk as funds typically own dozens if not hundreds of companies.

Lesson #3: Investing in Funds allows us to access professional investment managers and use index investing.

Lesson #4: Investing in Funds diversifies risk as funds own dozens of companies.

We then moved on to look at a definition of risk in post “2.4 Risk & Volatility” where we revisited inflation. We first looked at inflation in post “1.4 Inflation, Saving & Investing” where we saw how damaging it can be with the £13.60 coffee round being predicted to be £687 in 100 years’ time (again, we shudder when we see this number). In the long-term it’s historically been inflation that’s the real risk we face when it comes to becoming wealthy and we said that:

“For us, risk is very simple: “Will we be able to afford to buy all the things we want in the future?””

Most people see stock markets going up and down and think this is risk and in the short-term yes, it can mean we have less money. But historically, in the long-term it’s been inflation that’s the real risk with volatility being the price to pay to earn a return to beat it.

Lesson #5: In the long-term, historically the biggest risk faced has been inflation and volatility has been the price to pay to earn a return to beat it.

Part of our plan is to use index investing and so next we looked at how indexes work in post “2.5 Stock Market Indexes: The Basics.” We saw that in reality they are really simple, just having some definitions about how they are calculated such as the sample, how the companies are weighted and how often they are rebalanced. Indexes allow us to keep track of all the companies in them through one simple number. For us though, the most valuable thing is that we can buy ETFs that track indexes which is a great way to diversify and invest in lots of companies in a very cost-effective way.

We also mentioned Total Return Indexes which include dividends and show the total return an investor would receive from owning all the stocks in the index, not just the return from changes in the share prices.

Lesson #5: Stock Market Indexes are simply a way to keep track of a lot of companies by looking at just one number.

Lesson #6 We can buy ETFs that track indexes which allows us to diversify easily and cheaply.

We went on to look at indexes further in post “2.6 Stock Market Indexes: Examples & Problems” where we saw there are global indexes, country indexes, sector indexes and all manner of combinations of these. One potential problem was the fact that most of the major indexes are market value weighted and this can cause concentration risk. For example, the US made up 72% of the MSCI World Index and the top 10 stocks in the S&P500 represented 10% of the index. This concentration risk means we’re not as diversified as we think from the headline “World” or “500 stocks.” Over the long-term we take the view that this concentration can be a good thing if it results in an index backing winners.

Lesson #7: Stock Market Indexes are often market-value weighted which can cause concentration risk. Over the long-term this could be an advantage with the index backing winners.

Next we looked at the historic returns of the most well-known index, the S&P500, over the last 150 years. We took a detour and looked at log-scales to do this as it converts data to percentages which is really important when looking for consistency in a chart over long periods. What we saw was remarkable, if we had invested $1 in the S&P500 150 years ago it would now be worth $700,000. This is a CAGR of 10% which has comfortably beaten inflation of around 4% over the same period. The remarkable thing about the chart was its consistency with relentless growth decade-in, decade-out and there was not a single 15 year period that resulted in a loss. It’s well worth revisiting the chart as it’s the foundation of our belief in investing.

Lesson #8: For 150 years the S&P500 has historically returned a 10% CAGR which has comfortably beaten inflation of around 4%. Being patient, long-term investors is the key to building wealth.

We then went on to ruin our excitement in post “2.8 Stock Market Volatility: Drawdowns” where we looked at the drawdowns we would have suffered. We said it’s not just the size of the drawdown that’s important but also how long they last with long drawdowns being painful due to inflation eating away at our wealth month-in, month-out. We saw that drawdowns of up to 25% are common and they usually recover within a couple of years but there have also been half a dozen drawdowns bigger than this and we need to be prepared. This confirms what we said about risk, with volatility being the price to pay to earn the 10% return the index has generated.

Lesson #9: We must be prepared for large drawdowns on a regular basis. Reviewing the table of drawdowns frequently will help us to put current events into perspective and to stick to our plan.

We took a detour in post “2.9 Debt & Keeping Up With The Joneses” where we looked at The Yawns and The Joneses and the impact their spending choices have on their financial futures. We saw that using debt, not living within your means and not planning for the future results in a bleak financial outlook. We also introduced opportunity cost which is what you are giving up in the future if you spend money now. If you can invest and earn a 10% CAGR for decades then we saw the opportunity cost of not living within your means is staggering. For The Jones it was a retirement pot of £15 million but more importantly, they were heading for a future with nowhere to live and never being able to retire.

Lesson #10: To create a bright financial future you must live within your means and that means no debt.

Lesson #11: The opportunity cost of not saving is staggering both financially and in terms of the impact on your lifestyle in the future and the ability to enjoy retirement.

In post “2.10 What Do Funds Invest In?” we started to look at how funds invest. We saw they can slice the investment universe any way they like from: geography; to market value; to sector to investment styles such as value investing, growth investing etc; to themes; and any combination of these. We also saw the issue of diversification again as even if a property fund owns dozens of investments, they might all move together and behave like one investment if they are correlated. We also said there are thousands of funds to choose from and it might seem just as hard to pick which ones to invest in as it is to pick single stocks. However, in future posts we’ll see that it might just be a whole lot easier.

Lesson #12: There are thousands of funds to choose from that invest in dozens of different ways. This is good news as it gives us a huge pool to fish in to pick the best ones.

Finally, last month, we looked at our plan again in post “2.11 Our Plan: Pulling It All Together” where we broke it down into: Save; Invest; Build a Portfolio; Manage the Psychology of Investing; and Look to Improve. Although most people think the hardest part of investing is picking investments, we actually believe the hardest part of our journey is going to be managing the psychology. Keeping up our habits of saving and spending two hours a week on our plan; resisting the temptation to spend; and being able to get through the large and long draw-downs that we’ll face are going to be real challenges that should not be underestimated.

Lesson #13: Having a financial plan is one of the key reasons that you’ll be able to become wealthy. If you don’t have a plan you are like a ship without a rudder.

Lesson #14: We believe the hardest part of our plan is going to be managing the psychological challenges we’ll face on our journey.

CONCLUSION

Perhaps the most important things to take away from the last year are that we’ve been disciplined having not missed a single monthly saving of £50, we have resisted the temptation to spend our money and we are always thinking long-term.

The best example of what this can achieve is Warren Buffett who at the time of writing is worth $150 billion. When most people talk about Buffett’s success they usually fail to talk about the two key things he has done, without which, we would probably have never heard of him. Firstly, he has lived into his 90’s and this means he has invested for over 80 years. Secondly, he is well known for living within his means.

If we put these together with the 150 years of history of the S&P500 then quite simply, if we earn a 10% CAGR, invest for decades and resist the temptation to spend we should be able to create unimaginable wealth and follow in his footsteps.

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Wed 31-Dec-25 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 250 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 300 | 0 |

| Units last month | 725 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 725 | 10,000 |

| Unit Price £ | 1.4649 | 1.4649 |

| Fund Value £ | 1,062 | 14,649 |

| Total Wealth £ | 1,363 | 14,649 |

| FX Rate | 1.3471 | 1.3471 |

| Total Wealth $ | 1,835 | 19,734 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 86yrs 8mths | 77yrs 6mths |

Correction: last month we said we receive interest on our bank account at the end of December. This is not the case as we receive it at the end of January which is the anniversary of when we saved our first £50. Apologies for any confusion, we have amended last months’ post.

THE CRAZY FUND

| Results | 28-Nov-25 | 31-Dec-25 | MTD Move | YTD Move | LTD Move |

| Unit Price £ | 1.4527 | 1.4649 | 0.84% | 14.49% | 46.49% |

| FX Rate | 1.3240 | 1.3471 | 1.75% | 7.65% | 5.88% |

| Unit Price $ | 1.9234 | 1.9734 | 2.60% | 23.24% | 55.11% |

| CAGR £ | 21.59% | 21.02% | (0.57%) | (6.88%) | 21.02% |

It was a dull month for our investments with them nudging higher by just under 1% but never forget that small gains like this can produce remarkable results due to compounding. 0.84% per month compounded for 12 months is over 10.5% a year and so small gains are not to be underestimated. The FX rate to see what we’re worth in USD (the definition of a billionaire is in USD) moved in our favour this month and gave us a boost.

Below is a table of what the fund is invested in at 31/December:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 8.9% | 396.50 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 10.1% | 1,186.00 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 9.8% | 6,095.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.8% | 527.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 10.5% | 3,131.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 11.5% | 464.00 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 10.1% | 118.11 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 9.6% | 54,866.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 9.7% | 46,183.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 8.7% | 1,122.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.7% | ||||

| Cash | 0.3% |

On 11/Dec EQQQ went ex-Div and so we have included this in our cash balance, we received the dividend on 18/Dec. Otherwise, there were no changes to the portfolio during the month.

A FAVOUR

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please spread the word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month we’re going to do our annual portfolio rebalance for the second time. This will move our investments closer to equal weights as some have out-performed others over the last year. If you need to refresh yourself on rebalancing then we covered it in detail in post “2.1 Rebalancing a Portfolio.”

We’re also going to take a look at changing some of the investments in our portfolio for the first time following on from last month, where we said that part of our plan is to always look to improve what we’re doing.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

© TradeFloor Promotions Limited 2026