November 2025

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN

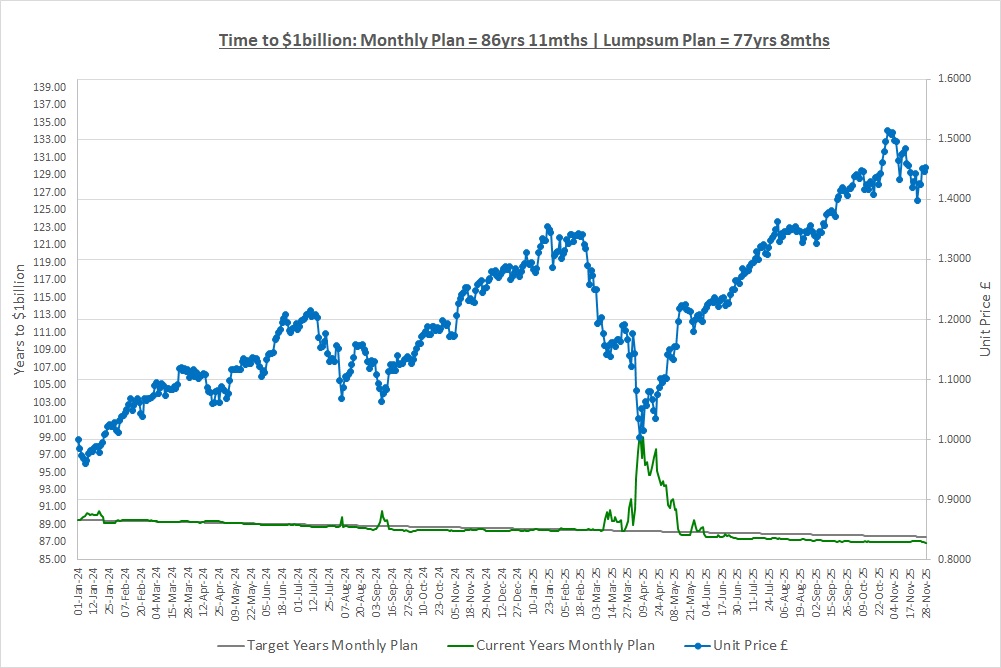

Our Lumpsum Plan will be worth $1billion in: 77yrs 8mths

Our Monthly Plan will be worth $1billion in: 86yrs 11mths

Last month we looked at what funds invest in as funds are the corner stone of our plan. We saw there’s an almost infinite number of ways a fund can choose to invest, slicing by a combination of geography, market value, sector, investment style, theme or any other way. We also looked at the AIC sectors which bring some order to all of this. There are thousands of funds to choose from which raises the issue that choosing a fund might be as hard as choosing a single stock. As we’ll see in future posts, choosing funds may in fact be a whole lot easier.

OUR PLAN

This month we’re going to remind ourselves what our plan is and consolidate what we’ve learn’t over the last 20+ posts. Our plan is simply to become unimaginably wealthy and we’re following two plans to achieve this:

The Monthly Plan:

We’ll save £50 a month and every 6 months, when we have £300, we’ll invest in the stock market. After 10 years we’ll stop saving but will carry on investing until we have $1 billion.

The Lumpsum Plan:

We start with £10,000 and we invest in the stock market until we have $1 billion.

We estimate that both plans are going to take one or two generations to reach our goal of $1 billion but although they appear simple, we’ve seen over the last 20+ posts that there’s a lot to understand if we want to succeed. This month we’ll look at five key areas needed to be successful which are that we: Save; Invest; Build a Portfolio; Manage the Psychology of Investing; and Look to Improve.

SAVE

The purpose of becoming wealthy is so that we can afford more things in life. In post “1.4 Inflation, Saving & Investing” we saw the devastating effects of inflation where a £13.60 coffee round will cost £687 in 100 years. Ignoring inflation is not an option if we want to be wealthy and although earning interest in the bank is a great start, we saw that over longer periods it will barely keep up with inflation as our £13.60 might only be worth £261 with interest.

However, saving is the foundation of our plan as it provides the capital we need to be able to invest. If you’re struggling to find £50 a month then taking a good look at your spending is a great place to start. To become wealthy, we must live within our means so we need to review every spending decision from streaming services to mobile phone contracts, to making a packed lunch for work and not buying too many coffees out. No one is going to do this for us so we just have to find a way to save.

With time you may find you can save more than £50 a month and if you can then you should. Some financial planners recommend saving as much as 20% of your income or more but you could start by aiming for 10%. This will make you reassess your spending and will put you on a path to wealth way beyond what £50 a month can achieve.

Remember, in post “2.9 Debt & Keeping Up With The Joneses” we saw an amazing lifestyle but it was heading for a cliff and we must not chase this. We said most of the incredible lifestyles we see are built on debt and eventually they all come crashing down. Be proud that you are saving to create a bright financial future and if someone laughs at your old phone then laugh with them and tell them “I don’t care, I’m on The Crazy Plan!” Whatever you do, you must save.

In that same post we also saw the enormous opportunity cost of debt which was £15 million for the Joneses. They were giving up retirement, a foundation for their family and being able to actually afford all those wonderful things in the future. Debt stops you from saving so you must be on top of debt and ideally clear it asap so you can save.

INVEST

Once we’ve saved we need to do something with our money and we saw that investing in the stock market has historically beaten inflation by a wide margin, potentially turning our £13.60 into £187,416. This means lots of coffee and cake even if they cost £687 (we still shudder when we see that number, £687 for 2 coffees and pastries?). So, our chosen way to beat inflation is to invest in the stock market.

We’re Investing in REAL Businesses

In post “1.6 Stock Markets” we talked about the companies involved when we brush our teeth from the toothpaste manufacturers to the advertisers to the water companies. These are real companies selling real products to millions and millions of people day-in, day-out. If we own shares in these companies we are part owners and if a company does well we own a share of the profits and the growth of the business.

We talked about companies like Microsoft, Amazon, Meta which owns Facebook, Alphabet which owns Google, Ford, Tesla, JP Morgan, Visa, Samsung, Unilever, Netflix, Coca-Cola, Nestle, the list goes on and on and on. Is this rocket-science? No, it’s just businesses that sell social media services, cars, banking, tech, food & drink and all sorts of things that we buy day-in day-out. Never think stock markets are complicated, they are simply places you can find everyday companies.

This is hugely important to understand, our plan is to own real businesses. We want to put this in red, in 1,000-font and hang it on your wall. We are going to be business owners and those businesses make profits which will be ours.

Target Return

In post “2.7 Stock Market Returns: Long Term CAGR” we saw that owning a broad selection of companies like the S&P500 has historically given a return of 10% a year. If we think of the S&P500 as one company selling lots of things then what this means is that it’s made its owners profits of 10% a year. If you buy something from a shop? The owners make 10% which doesn’t seem too unreasonable when you think about it.

We looked at 150 years of data and there wasn’t a single 15-year period that resulted in a loss for an investor. There is no guarantee that these returns will continue into the future but 150 years is a long time and it’s the consistency that was remarkable, with returns being decade-in, decade-out with a few exceptions.

Remember, Warren Buffett has made 20% a year for decades and so we have every chance of doing well. He is now worth $150 billion and if he makes 20% this year? He’ll make $30 billion in a year (!) and that’s how wealth is created, by letting compounding work its magic.

We’re going to try and beat the S&P500 which is not going to be easy. Our target is a 15% CAGR but even if we come up short, we should still become extremely wealthy. So, let’s look at the current table of wealth with our Monthly Plan worth $1,726 and the Lumpsum Plan worth $19,234 at the end of November.

Table of Wealth

| CAGR | 10.00% | 10.00% | 15.00% | 15.00% | 20.00% | 20.00% |

| Years | Monthly | Lumpsum | Monthly | Lumpsum | Monthly | Lumpsum |

| 0 | $1,726 | $19,234 | $1,726 | $19,234 | $1,726 | $19,234 |

| 10 | $15,542 | $49,887 | $21,480 | $77,811 | $29,641 | $119,090 |

| 20 | $40,312 | $129,395 | $86,900 | $314,790 | $183,526 | $737,376 |

| 30 | $104,560 | $335,617 | $351,557 | $1.3m | $1.1m | $4.6m |

| 40 | $271,202 | $870,505 | $1.4m | $5.2m | $7.0m | $28.3m |

| 50 | $703,427 | $2.3m | $5.8m | $20.8m | $43.6m | $175.0m |

| 60 | $1.8m | $5.9m | $23.3m | $84.3m | $269.7m | $1.1bn |

| 70 | $4.7m | $15.2m | $94.2m | $341.1m | $1.7bn | $6.7bn |

| 80 | $12.3m | $39.4m | $381.0m | $1.4bn | $10.3bn | $41.5bn |

| 90 | $31.8m | $102.2m | $1.5bn | $5.6bn | $64.0bn | $257.3bn |

| 100 | $82.6m | $265.1m | $6.2bn | $22.6bn | $396.5bn | $1.6tn |

| 110 | $214.2m | $687.5m | $25.2bn | $91.4bn | $2.5tn | $9.9tn |

| 120 | $555.5m | $1.8bn | $102.0bn | $369.7bn | $15.2tn | $61.1tn |

If we make a 15% CAGR then we should hit $1 billion in around 87 years on the Monthly Plan and 78 years on the Lumpsum Plan. Our family should be pleased even if we make 10% a year as we’ll still create enormous wealth. We can see that the wealth all comes at the back end and this is just the same as the Williams family and their tennis careers. If you remember, in post “1.3 CAGR & Crazy Plans” we talked about the years of practice they put in on the tennis court before they “suddenly” won championships and building wealth is no different.

Our wealth builds so slowly in the early years that people don’t believe we can make $1 billion but look what happens from around year 30, our wealth really starts to take off. Wealth takes time and that’s why the seemingly impossible is possible due to compounding.

How To Invest

We looked at trying to pick individual stocks in post “1.10 Choosing Companies to Invest In” and decided that we might not be any good at it and in post “1.11 Disasters & Solutions” we saw some horrendous outcomes. This approach will also take far more than a couple of hours a week and so we decided to use index investing and to find professionals.

This led us to look at three types of Funds including ETFs that track indexes such as the S&P500 and Unit Trusts / Mutual funds and Investment Trusts which are active funds with professional managers making all the decisions. Our plan is to buy funds but it’s extremely important to remember that if we buy a fund, we’re still owners of real businesses, nothing changes in that respect we just own them through a fund.

BUILD A PORTFOLIO

Diversifying

Owning a fund is a great way to diversify as typically a fund will invest in dozens if not hundreds of companies. However, we can diversify further by building a portfolio of funds and The Crazy Fund currently owns 10 funds with a mix of index tracking ETFs and Investment Trusts. We still might not be as diversified as it sounds though as some indexes and funds can be market-value weighted which causes concentration risk. We also own some funds in the same sector which causes concentration, we’re overweight technology for example but this is a choice and we’ll discuss this in future posts.

Rebalancing

To remain diversified across our funds and stop any one fund from dominating we can rebalance our portfolio back to equal weights annually. We did our first rebalance in January this year as we went over in post “2.1 Rebalancing a Portfolio” and our second rebalance is fast approaching.

Changing Our Investments

We made a single change to our portfolio in April last year but otherwise have not changed any of our investments in the last couple of years. This just shows how being patient can earn good returns. Going forwards we’ll start to see if we can improve our portfolio more often but we’ll always keep patience at our core as we’ll become wealthy due to compounding working it’s magic.

MANAGE THE PSYCHOLOGY OF INVESTING

Without doubt the hardest part of our plan is going to be psychological. There are several barriers we’ll come across and we’ll quickly look at some of the main ones starting by revisiting post “1.2 Sacrifice, Temptation & Commitment.”

Sacrifice & Commitment

Our plan requires us to sacrifice £50 a month or a lumpsum of £10,000. We also said we need to sacrifice a couple of hours a week to spend on our financial plan. The question is, how do we keep our commitment to saving and continue sacrificing our time as let’s face it, it’s an extremely long journey.

When we struggle, which we will, we must ask what the alternative is? Do you have another plan that will create the bright financial future you want? The table of wealth above clearly shows the journey and things really start to kick in around year 30 but we have to get there for it to happen. Back in post “1.2” we worked out the hourly rate as $107,158 when we spend time on our plan and that’s a decent rate and should help us remain committed!

The biggest motivation of all though should be our progress so far. In just under two years, our monthly plan has gone from zero wealth to £1,304 (or $1,726). Someone on either plan now has really good money habits and their wealth is growing year to year meaning they’re creating a bright financial future. Our plans are working and this is the biggest motivation of all.

Temptation

The temptation to spend is a constant risk but we must remember that “if we go and blow our £50 per month or find that there isn’t £10,000 down the back of the sofa, then there will never be $100,000. If there is never $100,000, then guess what, there will never be $1million and if there is never $1million, there will never be $1billion.”

We must immediately start thinking “this is not my money” and instead view ourselves as custodians or trustees. This is a lot like saving into a pension for 40+ years where a trustee looks after your money until you retire and then you take an income and we must treat this plan the same way. One day we’ll start to take an income from the fund and it will be very significant, but only if we get there.

The other thing we can do is not compare ourselves to others as we talked about in post “2.9 Debt & Keeping Up With The Joneses.” We’re building true wealth, not the illusion of wealth and that takes time but the rewards are far beyond what most people believe is possible.

Volatility

Stock markets are volatile and this presents a huge psychological challenge. Next month, we could suffer a huge drawdown similar to any of the ones we saw in post “2.8 Stock Market Volatility: Drawdowns.” Large and / or long drawdowns are really going to test our belief and commitment and there is no way of sugar coating them, they will be hard to deal with. We saw that drawdowns of up to 25% are extremely common but usually they don’t last too long, recovering in 3 years or less. We also saw some truly shocking drawdowns in the 150 years so we should be prepared.

Revisiting the table of drawdowns in that post will remind us that they are to be expected, are normal and have historically been the price to pay to earn the returns needed to beat inflation. Let’s also remember what we said about risk in post “2.4 Risk & Volatility.” Historically, in the very long-term, inflation has been the biggest risk, not volatility.

LOOK TO IMPROVE

We can’t sit around waiting to become wealthy, we need to be proactive and spend a couple of hours a week doing research and there are a few areas to focus on going forwards. This is a journey and we need to constantly look to improve.

Changing Our Portfolio

From now on we’ll regularly see if there’s anything we can do to make our portfolio better. Just like the S&P500 relegates and promotes companies every 3 months, we’re going to see if we can improve our portfolio every 3 months. We’ll not be perfect, there is no perfect portfolio except with hindsight and there will always be investments we’ve not found, better ways of building a portfolio, some accidents and terrible market events. However, we need to make sure we do our best and that our portfolio does not become stale.

Selecting Funds

If we’re going to change our investments more frequently we need to have a method for finding investments for our portfolio. How to find a fund is something we’re going to start to look at in the new year and is of course one of the most fundamental parts of our plan going forward now we have the base knowledge of what investing is.

Building a Portfolio

Once we have a shortlist of funds to consider, how do we decide which ones to put into our portfolio and whether to replace an existing investment? This is something that we’ll spend a lot of time on in the future.

CONCLUSION

Our plan is really simple on the surface with the important areas being: Save; Invest; Build a Portfolio; Manage the Psychology of Investing; and Look to Improve. We’ve spent 20+ posts to get here because if someone just tells you to do something without telling you why, it’s extremely hard to stick with it over the long term and you might not have the belief to start in the first place.

We’ve now laid the out the foundations of investing. Having this knowledge will give us the belief needed to stick to our plan and overcome the psychological barriers we’ll face on the journey.

As our regular readers know and new readers will see next, our plan is working. Both plans are on track to hit $1 billion and that should be the biggest motivation of all.

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Fri 28-Nov-25 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 200 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 250 | 0 |

| Units last month | 725 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 725 | 10,000 |

| Unit Price £ | 1.4527 | 1.4527 |

| Fund Value £ | 1,053 | 14,527 |

| Total Wealth £ | 1,304 | 14,527 |

| FX Rate | 1.3240 | 1.3240 |

| Total Wealth $ | 1,726 | 19,234 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 86yrs 11mths | 77yrs 8mths |

Another month and another £50 saved on the Monthly Plan. Small, regular saving really does start to add up when done consistently over many years. We’re at the start of our journey but already our wealth is building significantly on both plans.

By the end of December, we’ll have £300 of cash saved on the Monthly Plan and we’ll look to invest our savings early in the new year as we do every 6 months. Remember, £300 is small and can cause problems when investing and we talked about this and some solutions back in post “1.8 Investing Small Amounts & Correlation” so have a re-read if you need to before January comes.

THE CRAZY FUND

| Results | 31-Oct-25 | 28-Nov-25 | MTD Move | YTD Move | LTD Move |

| Unit Price £ | 1.5084 | 1.4527 | (3.70%) | 13.53% | 45.27% |

| FX Rate | 1.3157 | 1.3240 | 0.64% | 5.81% | 4.07% |

| Unit Price $ | 1.9846 | 1.9234 | (3.09%) | 20.12% | 51.18% |

| CAGR £ | 25.12% | 21.59% | (3.53%) | (6.31%) | 21.59% |

We lost over (3%) this month but the FX rate to see what we’re worth in USD moved a little in our favour. We don’t know what will happen in the short-term and we’re not going to worry, losses are just volatility and the price to pay for earning the long-run CAGR to beat inflation as we wrote about in post “2.4 Risk & Volatility.”

Below is a table of what the fund is invested in at 30/November:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 9.0% | 398.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 9.2% | 1,065.00 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 9.9% | 6,082.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.8% | 523.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 10.6% | 3,153.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 11.3% | 455.50 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 10.3% | 117.02 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 9.7% | 55,283.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 9.9% | 46,823.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 8.9% | 1,138.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.7% | ||||

| Cash | 0.3% |

On 20/Nov SMT went ex-Div and so we’ve included this in our cash balance, we will receive the dividend on 12/Dec. Otherwise. there were no changes to the portfolio during the month.

A FAVOUR

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

MERRY CHRISTMAS AND A HAPPY NEW YEAR!

We just want to say a huge thank you to all of you who have subscribed to our posts by email and to those of you who are new to The Crazy Plan and are reading our posts on-line. This is the last post we’ll publish in 2025 and so we want to wish you all a very merry Christmas and a Happy New Year! See you in 2026 for year three!

NEXT MONTH

Next month’s post covers the end of our second year and if we’re honest, we can’t believe another year has gone by so quickly. We’re pleased to have maintained our discipline and good money habits and next month we’ll review the year and what we’ve learnt.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

© TradeFloor Promotions Limited 2025