October 2025

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan. All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN

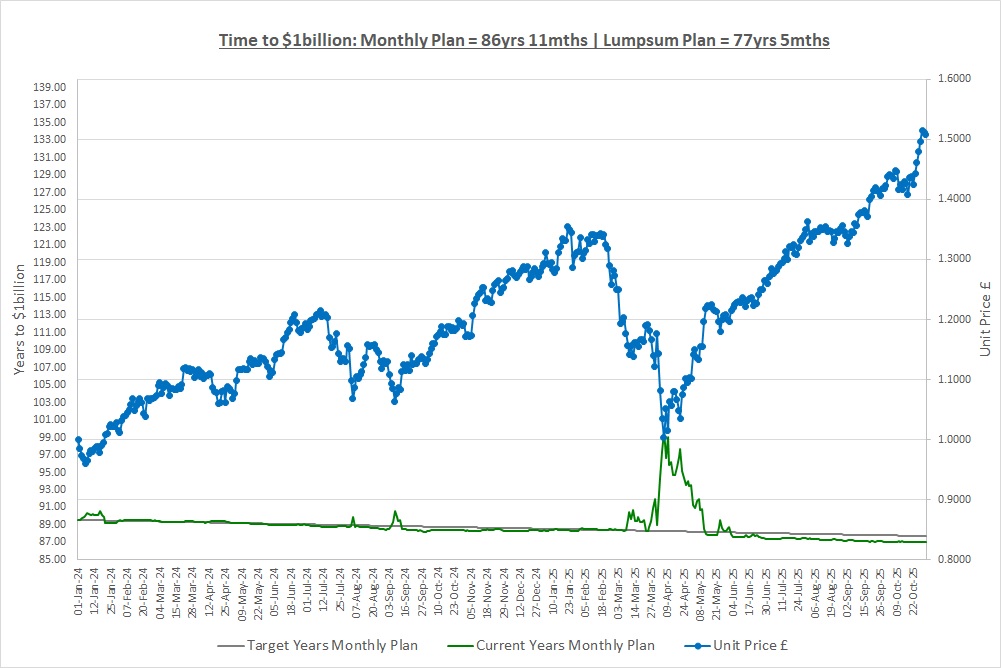

Our Lumpsum Plan will be worth $1billion in: 77yrs 5mths

Our Monthly Plan will be worth $1billion in: 86yrs 11mths

Over 80% of people who read our posts do not subscribe. If you want to build a bright financial future and find our posts helpful then in exchange, please sign up to receive them by email using the subscribe box at the top of our website. The more people that subscribe then the more we grow which means we can create more content to help you become wealthy beyond your wildest dreams.

Last month we talked about debt and the damage it can do to your financial future. Just because someone will lend you the money doesn’t mean you can afford the stuff you want to buy. A lot of the visible wealth we see all around us if often an illusion, there is no wealth behind it just debt. Eventually the debt catches up with people as we saw with the Joneses where the opportunity cost of having loads of stuff now was huge. The Yawns were looking forward to a retirement with wealth of over £3 million compared to the Joneses who were going to have to literally work until they died. The Joneses current and future wealth was zero despite earning four times more than the Yawns.

This month we’re going to have a look at what funds invest in as we haven’t really covered that yet but first it’s that time of year again…

DEJA VUE: BLACK FRIDAY, CHRISTMAS & OTHER EXCUSES TO SPEND MONEY

Yes, the shopping silly season is approaching again so we’re going to repeat what we said last year but with updated numbers. Back in post “1.2 Sacrifice, Temptation & Commitment” we talked about what it’s going to take to make our family billionaires. We said one of the most important things will be “whether or not we can resist the temptation to spend the money” and two big temptations are looming.

Our Monthly Plan is now worth £1,294 ($1,703) and the Lumpsum Plan £15,084 ($19,846). As Black Friday sales and Christmas approach there’s a real temptation to dip into these funds and to skip saving into the Monthly Plan. However, no matter how hard it is, we have to resist this temptation and that includes loading up the credit cards. If we feel under pressure to buy “stuff” the best approach is to have a conversation with our family and tell them we’re on The Crazy Plan, we’re finally living within our means and we’re saving for a brighter future.

Our commitment to this plan is going to be tested and we must not throw away all we’ve achieved over the last 22 months. Remember, “if we go and blow our £50 per month or find that there isn’t £10,000 down the back of the sofa, then there will never be $100,000. If there is never $100,000, then guess what, there will never be $1million and if there is never $1million, there will never be $1billion.”

We must not try to keep up with the Joneses. Our plan is working and if you’re on the Monthly Plan, then perhaps for the first time in your life you have some wealth and can see a brighter financial future ahead. Whatever we do, we must not throw away 22 months of hard work, we must stay on track to creating the financial future we dream of.

WHAT DO FUNDS INVEST IN

There are so many ways that funds invest that we could spend a lifetime describing them. Don’t worry, we’re not going to, but even so we still expect this post to ruin the next 15 minutes! If you get to the end of this post and are confused and dismayed then we’ll have succeeded in our aim which is to show just how complicated this can all become.

The first thing to remember is what we’re doing if we invest in a fund. It doesn’t matter if we invest in an index-tracking ETF, an Investment Trust or a Unit Trust / Mutual Fund, we will make or lose money depending on how the companies the fund invests in perform. Back in post “1.6 Stock Markets” we talked about toothpaste and everything from the mining companies to the advertising companies that are involved in getting toothpaste to us. We said if you buy shares in these companies you can benefit from being a part owner of their profits and growth which in the past has resulted in that magic 10% CAGR for the S&P500.

So, when we invest in funds we become part owners of the businesses the fund invests in. We’re not investing in some weird financial product, we’re investing in real life businesses that sell us all the goods and services we buy day in, day out and it’s extremely important to remember this.

There are so many ways that funds decide how to invest that it’s impossible to give a complete picture but we’ll try and get a good overview, starting with geography.

GEOGRAPHY

One way that funds may focus is by geography. Global funds will invest in stocks from all around the world whereas country specific funds invest in stocks from just one stock market. We saw a couple of examples of both of these in post “2.6 Stock Market Indexes: Examples & Problems” when we looked at the MSCI World Index and of course the S&P500 which is US. Given that there are around 100 countries with stock markets in the world, the number of funds to choose from is huge and remember, the total value of all these markets is around $100 trillion.

Additionally, some funds might invest in regions so for example Asia Pacific, Europe, North America etc where each region is made up of several country stock markets. If that wasn’t enough, remember that funds may be Passive like the ETF index trackers we’ve looked at or Active where the managers do their research and decide what to invest in.

MARKET VALUE

Some funds might decide to invest based on the market capitalisation (value) of companies. We’ve already seen this at the country level with the S&P500 being the largest 500 companies by market value. Companies can also be put into a market value bucket and then a fund focuses on just those companies. Typical buckets are:

| Micro Cap | <$300m; |

| Small Cap | $300 million – $2 billion |

| Medium Cap | $2 billion – $10 billion |

| Large Cap | >$10 billion |

A fund that invests in Micro or Small Cap might be looking to find the next Amazon before it takes off. Funds investing in Large Cap might be looking for quality companies with stable earnings and steady growth which are considered less risky than finding the next Amazon.

SECTOR

Another way for a fund to invest is to focus on a sector and back in post 2.6 we also looked at the MSCI World Information Technology Index. There are a vast number of sectors such as Information Technology, Financials, Property, Infrastructure, Biotechnology, Energy and the list goes on. Focusing on a sector means a fund builds up expertise in that one area to allow them to generate better returns from their knowledge advantage. For example, selecting property stocks to invest in requires a different set of skills to selecting a biotechnology stock. Again, we can find Passive ETFs that track indexes or Active managers who select which investments the fund holds.

INVESTMENT STYLES

Back in post “1.10 Choosing Companies to Invest In” we decided that buying what we “liked” was probably not a good idea and so looked at different investment styles for choosing investments including Value Investing, Growth Investing, Quality Investing, Momentum Investing and Blended Styles.

There are therefore funds available that invest based on style with some being experts in Value Investing and others at Momentum. Traditionally, investing based on styles was usually done by Active funds where expertise was key. As the ability to process data has increased, passive indexes have been set up with rules based on investment styles, in other words the definition of a style has been coded up as a formula and this is used to calculate the index. You can now buy ETFs that track a US market Value Index such as the MSCI USA Value Index for example or a European Growth Index such as the MSCI Europe Growth Index or you can buy an Active fund where the managers select investments.

THEMES

Some funds might decide to focus on a theme that cuts across several or all of the above ways of selecting stocks. One that has been fashionable recently is space. Funds have been set up to invest in the commercialisation of space and they invest in all aspects of the space supply chain from rockets themselves to communications & satellite companies to industrial engineering companies. If you can think of a theme then there’s quite possibly a fund that’s investing that way.

PERMUTATONS

Just to confuse us further, a fund might decide to invest in any combination of the above ways so they might invest in Asia Pacific, Small Cap, Information Technology companies with a Growth bias. The number of ways for a fund to choose how to invest is huge and we’ve only just scratched the surface!

Luckily for us, there is some order to all the above as there are some (semi!) standard classifications of funds according to certain criteria so we’ll take a quick look at some next.

UK – THE AIC SECTORS

In the UK, the Association of Investment Companies (“AIC”) oversees all investment trusts listed on the UK stock market. They classify companies based on, for example, how much of their revenue comes from Property and then assign a sector to the investment trust based on the revenue split. Below is the table of sectors that the AIC puts investment trusts into and there are 7 broad categories with 48 resulting sectors!

| UK | SPECIALIST |

| – UK All Companies | – Biotechnology & Healthcare |

| – UK Equity & Bond Income | – Commodities & Natural Resources |

| – UK Equity Income | – Environmental |

| – UK Smaller Companies | – Financials & Financial Innovation |

| OVERSEAS | – Growth Capital |

| – Asia Pacific | – Hedge Funds |

| – Asia Pacific Equity Income | – Infrastructure |

| – Asia Pacific Smaller Companies | – Infrastructure Securities |

| – China / Greater China | – Insurance & Reinsurance Strategies |

| – Country Specialist | – Leasing |

| – Europe | – Private Equity |

| – European Smaller Companies | – Renewable Energy Infrastructure |

| – Global | – Technology & Technology Innovation |

| – Global Emerging Markets | PROPERTY |

| – Global Equity Income | – Property – Debt |

| – Global Smaller Companies | – Property – Europe |

| – India / Indian Subcontinent | – Property – Rest of World |

| – Japan | – Property – UK Commercial |

| – Japanese Smaller Companies | – Property – UK Healthcare |

| – Latin America | – Property – UK Logistics |

| – North America | – Property – UK Residential |

| – North American Smaller Companies | – Property Securities |

| FLEXIBLE | DEBT |

| – Flexible Investment | – Debt – Direct Lending |

| VCT | – Debt – Loans & Bonds |

| – VCT | – Debt – Structured Finance |

| – VCT AIM Quoted |

The AIC only covers investment trusts so what about ETFs and Unit Trusts / Mutual Funds? Well, the sectors for these will closely map (but not exactly) the AIC categories. Other countries will have very similar classifications as Property or Healthcare are easy to define but they might also have some country specific sectors. We see this with the “UK” sectors above as the AIC is UK based.

DIVERSIFICATION

Back in post “1.11 Disasters & Solutions” we said that one way to avoid a disaster was to diversify by owning more than one investment. This diversification can start to break down though if you invest in a very specific fund.

If you invest in a property fund then even though the fund might own 50 or 100 stocks, they are all in the property business. Stocks in a sector tend to move together so if property investing is out of fashion, nearly all of the 50 or 100 stocks the fund owns will go down together and it will turn out that you’re not diversified at all. Even great companies can go down if the sector is out of fashion.

We’ve also seen a diversification problem due to market-cap weighting of indexes. In post “2.6 Stock Market Indexes: Examples & Problems” we saw that although the S&P500 is made up of 500 stocks, due to market weighting the top 10 companies made up 35% of the index so it’s not as diversified as “500 stocks” sounds. The same market-cap weighting problem arose with the MSCI World Index where the US was 72% of the index despite there being around 100 countries with stock markets in the world.

This concentration risk will come up again and again and is an area we’ll look at in future posts. Sometimes we might want to reduce the risk and other times we might use it to invest in funds that offer us what we need to achieve our goal of making $1 billion.

You’ll be pleased to know we’re going to stop there but hope we’ve achieved our aim of ruining the last 15 minutes for you! If you’re confused and dismayed thinking how-on-earth are we supposed to decide what to invest in, it’s worse than single stocks, then we’ve succeeded with this post!

SUMMING IT ALL UP

Back in post “1.11 Disasters & Solutions” we concluded that investing in single stocks was way-too difficult, we might not be any good at it and it would take more than 2 hours a week. We decided we needed a different plan and said we would use Index Investing and Employ a Professional instead. We then spent the last year talking about Index tracking ETFs and funds, which are professionals who do all the work for us.

We’ve now discovered there are thousands of funds to choose from and we might have gone down a dead end as selecting a fund could be as hard as selecting a stock. If we want to buy a Quality focused Global fund then surely we need to know all about global companies and quality investing and how can we do that in just 2 hours a week? Well maybe, or maybe not, because as we’ll see in future posts, picking a good fund might be easier than picking a good stock.

This post has shown that there’s a big pool to fish in to select funds from and that’s good news. Our job going forwards is to cut through all this information overload and find good solid funds to invest our money in. If we can do that then we should be able to invest confidently for just 2 hours a week of work.

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Fri 31-Oct-25 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 150 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 200 | 0 |

| Units last month | 725 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 725 | 10,000 |

| Unit Price £ | 1.5084 | 1.5084 |

| Fund Value £ | 1,094 | 15,084 |

| Total Wealth £ | 1,294 | 15,084 |

| FX Rate | 1.3157 | 1.3157 |

| Total Wealth $ | 1,703 | 19,846 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 86yrs 11mths | 77yrs 5mths |

Another £50 saved on the Monthly Plan. Both plans have again resisted the temptation to spend and this is key as the spending silly season approaches.

THE CRAZY FUND

| Results | 30-Sep-25 | 31-Oct-25 | MTD Move | YTD Move | LTD Move |

| Unit Price £ | 1.4184 | 1.5084 | 6.35% | 17.89% | 50.84% |

| FX Rate | 1.3445 | 1.3157 | (2.15%) | 5.14% | 3.42% |

| Unit Price $ | 1.9070 | 1.9846 | 4.07% | 23.94% | 55.99% |

| CAGR £ | 22.12% | 25.12% | 3.00% | (2.78%) | 25.12% |

Our investments had a great month and made over 6% but the FX rate to see what we’re worth in USD went against us by (2%) so we ended up 4% which is still a fantastic month. We keep saying this, but there will be terrible periods ahead and our CAGR will come down significantly over the coming years. None the less, we are making hay while the sun shines and are on track. This is how investing works, fantastic periods where we make outsized returns followed by big and sometimes long drawdowns as we saw in post “2.8 Stock Market Volatility: Drawdowns.”

Below is a table of what the fund is invested in at 31/October:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 8.9% | 408.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 9.7% | 1,171.50 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 9.6% | 6,154.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.8% | 543.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 10.8% | 3,339.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 11.4% | 476.50 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 10.5% | 123.35 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 9.5% | 55,743.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 9.8% | 48,183.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 8.6% | 1,142.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.8% | ||||

| Cash | 0.2% |

There were no changes to our investments during the month and none went ex-div.

A FAVOUR

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month we’re going to take a look at our plan in a little more detail and go over a few of the key areas that will allow us to achieve our goal of making $1 billion.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

© TradeFloor Promotions Limited 2025