September 2025

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN

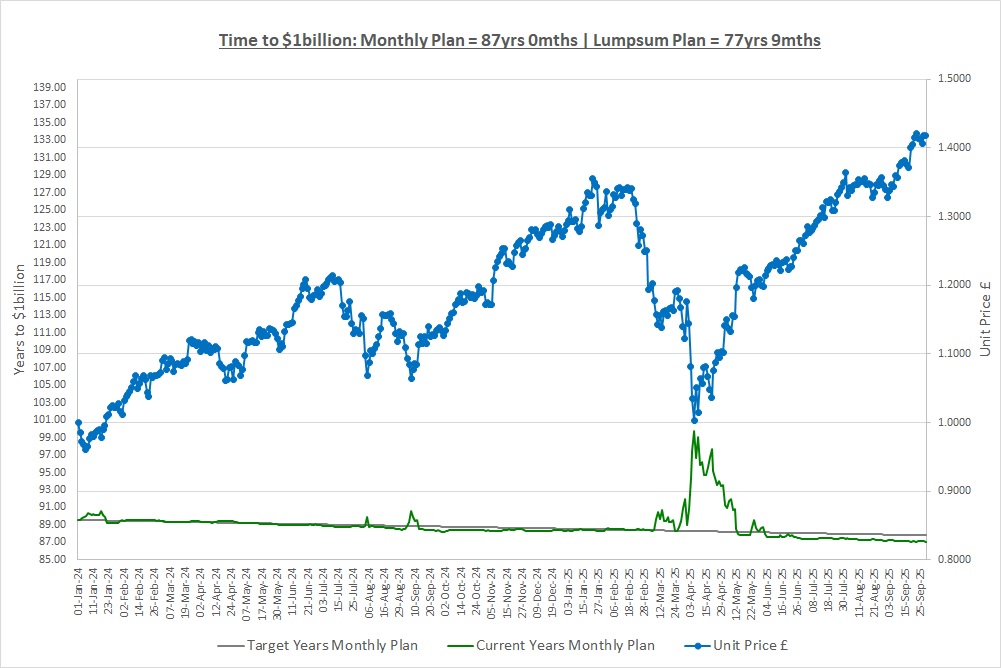

Our Lumpsum Plan will be worth $1billion in: 77yrs 9mths

Our Monthly Plan will be worth $1billion in: 87yrs

Over 80% of you who read our posts do not subscribe. If you want to build a bright financial future and find our posts helpful then in exchange, please do us a favour and sign up using the subscribe box at the top of our website. The more people that subscribe then the more we grow which means we can create more content to help you become wealthy beyond your wildest dreams.

Last month we looked at one side of stock market volatility, drawdowns. If you remember, a drawdown is the amount of money you’ve lost from your peak wealth as a percentage of that peak. We said it’s also good to look at how long drawdowns last as really long drawdowns are painful as inflation doesn’t wait, it just keeps eroding our spending power.

We looked at S&P500 drawdowns using monthly data for the last 150 years. We saw that 10 to 15% drawdowns are extremely common and only 24 of the 166 drawdowns were longer than a year which is extremely good news. Drawdowns greater than 25% were not so common and historically have recovered within 3 years or so. The Stock Market crash of 1929, the 2000’s tech bubble burst and the 2007/8 financial crash were the 3 biggest drawdowns with each being over 40% but they have all been recovered and new highs made.

This month we’re going to move away from investing quickly and have a look at debt and the constant pressure we might feel to keep up with the Joneses.

DEBT

We’re going to state the obvious: debt is when you borrow money and then pay it back, plus interest, over a period of time. There are all kinds of places you can borrow money from such as a bank, credit card company, finance lease company, credit institution, mobile phone company (do you own your phone or lease it?) and dozens of others. It’s so easy to borrow money nowadays that we could almost believe borrowing is fine since everyone does it.

Our parents grew up when credit cards had not even been invented and there was no access to debt apart from a mortgage to buy a house. As a result, they had to save up to buy everything and this meant that once they’d saved enough, they really thought hard about whether they wanted that 10th video streaming service! Ok, there weren’t video streaming services but you get the point!

Ask yourself this, why would someone lend you money? The answer is not to help you out, it’s because they will make money out of you from the interest they charge and that usually means it’s a bad deal for you. The problem with debt is that initially all seems well but over time, it slowly destroys your ability to become wealthy as we’ll see soon when we meet the Yawns and the Joneses.

There are a couple of exceptions, a mortgage and a high-ticket item such as a car, but even in these cases you need to be extremely careful. Just because someone will lend you the money to buy a £30,000 car doesn’t mean you can afford a £30,000 car. You should always sit down and think about what you can really afford, which could be a second-hand car for £10,000.

If you see what you can borrow and then see what you can buy you’ll always end up spending too much on something. Whoever is lending you the money will lend you the maximum they possibly can so they can make as much money out of you as they can. Debt should be considered extremely carefully and not used to buy things that are really out of reach.

Just think about our plan, we are going to become billionaires. Our plan relies on having no net-debt since a billionaire is someone who has $1 billion, not someone who has $1 billion of assets and $800 million of debt for a net wealth of $200 million. This shows that at some point you need to be debt free (sort of) and the sooner you start the better. Avoid debt or at the very least, use it incredibly sparingly.

Okay, time to meet the Yawns, the most boring family you could meet, and the Joneses who have the most amazing life which is just about to come crashing down.

THE YAWNS

Mr & Mrs Yawn are 40 years old, have two kids and live in a terraced house worth £300,000. They look after the house themselves, doing the washing, ironing, some DIY and gardening and drive a ten-year old car worth around £10,000 which is still good for another 50,000 miles. They have a family takeaway once a month and go out to local restaurants to celebrate birthdays and anniversaries and occasionally if they feel like a treat. They take the bus or their car if they are all going out.

Their kids go to a state school and they pay for after-school clubs including music lessons, football and ballet. They go on holiday abroad once a year, usually to Spain, but they go inland away from the coast where they can rent a villa for under half what the coastal properties rent for and they cook a lot of their meals in the villa.

They earn £65,000 a year between them and have a £50,000 mortgage left on their home, they both pay into a pension and also save outside of their pension and they have no debts. The Yawn’s live a very happy life and don’t really want for anything.

THE JONESES

Mr & Mrs Jones are also 40 years old with two kids but they live in a semi-detached house worth £1 million. They have a housekeeper who comes in one day a week to do all the washing and ironing and to keep the house tidy, the gardener spends a day a week keeping the outside beautiful and if a light bulb blows they call an electrician. They recently bought a brand new £75,000 Porsche and a brand new £50,000 Mercedes and they have their cars washed once a week. They eat out a couple of times a week and once a month go to a Michelin Star restaurant. They take taxi’s everywhere as they can’t stand the bus.

Their kids go to private school costing £25,000 a year each and they have additional private lessons as well as extra school trips including the annual ski trip costing £3,000 per child. They go on at least three holidays a year to exotic locations like the Maldives, the Seychelles and the Caribbean and their holiday budget is over £50,000 a year. Both Mr & Mrs Jones have Rolex watches and all the latest phones and fashion as they feel these things show how successful they are.

They earn £250,000 between them but rent the house and have car leases of £100,000 still outstanding. They have no money left at the end of the month and don’t pay into pensions, let alone additional saving. Their view is that they’re only 40 years old so there’s plenty of time to worry about retirement. They each have credit card debts of £30,000 but haven’t told the other one for fear that it might cause an argument. They also live a happy-ish life but want more like business class flights, another holiday, a bigger house and all sorts of other things. Due to the ever-increasing credit card debts, they’ve both started to not sleep well.

THE YAWNS v THE JONESES

Without doubt, the lifestyle of The Joneses is quite simply off the scale but we must be extremely careful not to try and keep up with them. Their whole life is built on debt and it’s starting to show with not being able to keep up with the credit card repayments causing sleepless nights. Let’s take a look at what each family is worth and have a think about a possible retirement in 25 years’ time:

| Retire at age 65 | The Yawns | Retirement | The Joneses | Retirement |

| Home Equity | £250,000 | £800,000 | £0 | £0 |

| Cars | £10,000 | £0 | (£25,000) | £0 |

| Credit Cards | £0 | £0 | (£60,000) | £0 |

| Pensions | £200,000 | £1,700,000 | £0 | £0 |

| Investments | £150,000 | £1,300,000 | £0 | £0 |

| Total | £660,000 | £3,800,000 | (£85,000) | £0 |

For the Yawns, if their house increases in value by 4% a year then it will be worth around £800,000 when they retire. But it’s their pensions and investments that are most interesting as if they make more contributions and they return an 8% CAGR then they are projected to be worth at least £3 million. This means they’re able to look forward to an incredible retirement and they’ll be able to relax and do whatever they choose.

For the Joneses on the other hand, the future could not be more different or bleak. They rent their house and so have no equity in it. Their cars are worth £25,000 less than they paid for them and are decreasing in value every month and they have huge car leases to pay off. They have nothing saved for a rainy day let alone retirement and their credit card debts are unaffordable and getting worse by the month.

The Joneses are heading for a financial cliff and will literally have to work until they die unless they change course rapidly. They’re living way beyond their means with the housekeeper, gardener, cars, school fees, holidays, fashion and restaurants and they’re financing it with credit cards and car leases. The fact that they earn four times what the Yawn’s earn is irrelevant, each month that goes by is moving them ever closer to the cliff.

OPPORTUNITY COST

If you haven’t heard of the term opportunity cost then it’s simply the value of something you choose to give up so that you can have something else. Debt has a huge opportunity cost as we can see above. The Joneses are choosing to not save for their future so they can have lots of stuff now.

The Yawns are on track to be worth almost £4 million when they retire despite earning only one quarter of what the Joneses earn. Very simplistically, this means that if they had chosen to, the Joneses could have been on track to be worth £15 million when they retire as they earn four times as much. Instead, they won’t be retiring as you can’t pay the bills if you’re worth nothing and where will they live? This is no joke, how can you retire if you can’t pay the rent let alone for anything else?

The opportunity cost of the Jones’ spending is £15 million but there are also other non-financial opportunity costs as well. They are giving up their health as they are stressed over debts and they are also giving up a retirement. Opportunity cost is very real and it is driven by our choices as we can see with the Joneses.

CONCLUSION

Organisations only lend money to make money from the person they lend to, that’s their business and so they will lend you as much as they can. This makes you believe you can buy things that you really can’t afford and you end up borrowing from the future. The Joneses have used debt to finance a lifestyle they can’t afford and that’s not sustainable over the long-term. They are a perfect example of the difference between the illusion of wealth and real wealth. Most of what you see nowadays is an illusion of wealth built on debt and it will eventually come crashing down. There are very few people that earn enough to support the lifestyles we see.

Don’t ever feel pressure to keep up with the Joneses. If someone laughs at your phone or when you take the bus, then laugh with them and say “I know, but I don’t care as I’m on The Crazy Plan!” One day, you will have no debt and £1,000 saved as the Monthly Plan now does. Then it will be no debt and £2,000, then no debt and £5,000, then tens and hundreds of thousands, then millions and then eventually your family will be in the super-league. Who will be laughing then?

The opportunity cost of borrowing is staggering. If you live within your means and build a sustainable lifestyle you can save and invest and create unimaginable wealth if you are patient. This wealth will not be an illusion, it will be real wealth. Use debt extremely cautiously and remember there are no short-cuts to wealth. Investing for the future and earning a 10% CAGR makes the journey to $1 billion possible for anyone.

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Tue 30-Sep-25 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 100 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 150 | 0 |

| Units last month | 725 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 725 | 10,000 |

| Unit Price £ | 1.4184 | 1.4184 |

| Fund Value £ | 1,028 | 14,184 |

| Total Wealth £ | 1,179 | 14,184 |

| FX Rate | 1.3445 | 1.3445 |

| Total Wealth $ | 1,585 | 19,070 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 87yrs | 77yrs 9mths |

There are a couple of milestones we should celebrate this month, one for each plan.

The Monthly Plan owns 725 units in The Crazy Fund and the unit price went from 1.3458 at the end of August to 1.4184 this month. That means our investments made £52.64 which is more than our monthly contribution of £50! This is an incredible achievement, our money worked harder than we did and this is the power of compounding. Just stop and think about this, it’s remarkable, we did nothing but we earned more than our monthly savings.

Also, the Lumpsum Plan is now predicted to take less than 78 years to make £1 billion which if you are thinking about family and a legacy, is not long at all.

Of course, any drawdown in the future will quickly reverse both of these achievements. However, it’s extremely important we celebrate milestones as it reminds us that we’re on track to make $1 billion.

THE CRAZY FUND

| Results | 29-Aug-25 | 30-Sep-25 | MTD Move | YTD Move | LTD Move |

| Unit Price £ | 1.3458 | 1.4184 | 5.40% | 10.85% | 41.84% |

| FX Rate | 1.3508 | 1.3445 | (0.47%) | 7.44% | 5.68% |

| Unit Price $ | 1.8179 | 1.9070 | 4.91% | 19.10% | 49.89% |

| CAGR £ | 19.57% | 22.12% | 2.55% | (5.78%) | 22.12% |

It was a great month for The Crazy Fund with our investments making 5% and the FX rate to see what we’re worth in USD hardly moving. This has had a big impact on our CAGR since we started back in January last year, driving it up to 22% As we keep repeating, this is way-higher than our long-term expectations and will come down over the coming years. However, it shows how important it is to take a long-term view when investing as you never know when the good periods will come.

Below is a table of what the fund is invested in at 30/Sep:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 9.2% | 397.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 10.0% | 1,137.50 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.0% | 5,997.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.6% | 498.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 10.5% | 3,053.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 11.2% | 437.50 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 10.2% | 115.27 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 9.5% | 52,886.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 9.7% | 44,707.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 8.8% | 1,096.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.7% | ||||

| Cash | 0.3% |

On 11/Sep, EQQQ went exDiv and paid on 18/Sep. Otherwise, there were no changes to the portfolio during the month.

A FAVOUR

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month we’re going to go back to funds and have a look at what they invest in. We’ve already looked at some examples of ETF trackers but what about all the other funds out there, what do they invest in? Next month we’ll take a look.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

© TradeFloor Promotions Limited 2025