April 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN

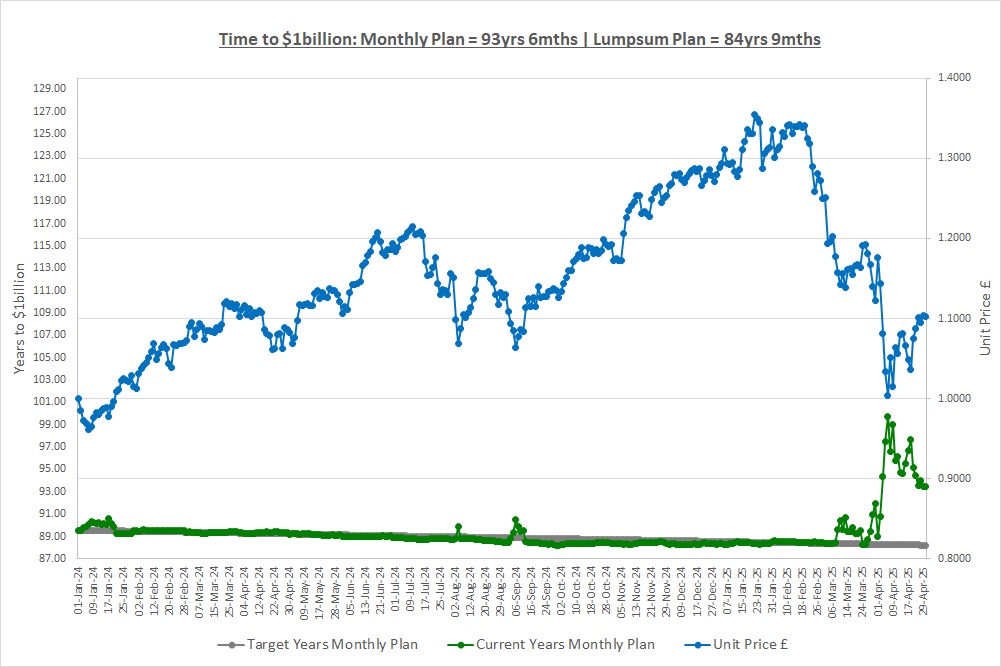

Our Monthly Plan will be worth $1billion in: 93yrs 6mths

Our Lumpsum Plan will be worth $1billion in: 84yrs 9mths

Last month we talked about ETFs and Investment Trusts and saw they are very similar to Unit Trusts / Mutual Funds as they are just a pool of money from lots of investors which the investment manager invests on their behalf. The main difference is that ETFs and Investment Trusts are listed on the stock market and in the case of Investment Trusts, they are closed-end meaning the amount of money in the fund does not change from day to day. This can be an important point to reduce some specific risks which we’ll talk about in a later post. We also said that for our purposes we’ll think of ETFs as being passively managed which results in lower costs.

This month we’re going to talk about Risk and Volatility. We were going to write this post later in the year but given the turbulence of stock markets recently we’ve brought it forward as we don’t want to appear to have our head in the sand when it comes to these two topics. So, let’s start with volatility.

VOLATILITY

Volatility is simply a measure of how much something moves around by. There are lots of mathematical formulas that can be used to calculate it but we’re not going to worry about those, instead we’ll look at a couple of examples to show what volatility is.

A bank account is not volatile. If you put £100 into a bank account there will always be £100 (assuming it’s a reputable bank that does not go bust). The value of your savings does not change from day to day, they are always worth £100 plus any interest you receive. On the other hand, investing in the stock market is volatile. If you invest £100 in the stock market then the next day it might be worth £102, only to fall to £97 and then go up to £105. We’ve seen this with the The Crazy Fund over the last year as its value fluctuates from day to day and month to month. So, volatility just tells us whether or not the value of an investment moves around from day to day with some investments having low or no volatility and others having huge volatility.

It’s really important to understand that volatility tells us nothing about the direction of travel and whether the investment has gone up or down in value, it just tells us that the journey was noisy. Last year stock markets were volatile, they went up and we made money. This year they’ve been volatile, they’ve gone down and we’ve lost money.

So, volatility is not risk, volatility is noise. It’s only when volatility is combined with other factors that it might lead to risk as we’ll see shortly.

RISK – A FUNDAMENTAL DEFINITION

We believe in focusing on the fundamental risk that we and our families face and then thinking about what drives that risk. All too often people believe the drivers of risk are the risk itself and that can lead to a sub-optimal investment strategy.

In post “1.4 Inflation, Saving & Investing” we said “All money really is, is a measure of how much stuff we can buy, the more money we have the more stuff we can buy, it’s that simple. If we can buy more stuff then we can have a better life.”

For us, risk is very simple: “Will we be able to afford to buy all the things we want in the future?”

If we will be able to afford them then our risk is low, if we won’t then we’re taking a lot of risk. There is of course the issue of what timescale “the future” is and we’ll think of the short-term as less than 10 years and the long-term as over 10 years. So, that’s our definition of risk, will we be able to afford the things we want in the future? Now we can look at the different drivers of risk.

DRIVERS OF RISK

There are many drivers of risk but we’ll look at what we consider to be the 5 key ones:

- Saving Enough

- Resisting the Temptation to Spend

- A Permanent Loss of Money

- Inflation

- Volatility

The first three of these are the foundations we need to put in place as without them, we have no chance of becoming wealthy. The last two are very much dependent on our time horizon as we’ll see but how we approach them is the key to whether or not we’ll become wealthy.

The Foundations

If we don’t save enough or don’t resist the temptation to spend then we’ll never become wealthy as we’ve talked about repeatedly in previous posts. We realise in the real world it can be extremely hard to do these but if we want a better financial future we quite simply have to do these basics. Only we can do this, no one else and so we must remain committed to our plan.

A permanent loss is something we discussed post in “1.11 Disasters & Solutions” when we talked about reducing the possibility of a permanent loss by diversifying and using stop-losses. Reducing the risk of a permanent loss is something we’ll come back to time and again on our journey and it will end up being our key focus but for now, we ended up deciding to employ a professional and use index investing to mitigate this. So, let’s now look at the last two drivers of risk.

Risk in the Short-Term (under 10 years)

In the short-term, the main reason we’ll not be able to afford the things we want will most likely be because of volatility. One day we’re looking at the value of our investments and think “great, we can buy loads of stuff” and the next day stock markets have sold off and we can no longer afford those things. Volatility in the short-term is a real problem, who cares if prices have gone up by 1 or 2% due to inflation if we’ve lost 20% in a week? This is something we are experiencing at the moment.

So, volatility will lead to a temporary loss of money but the problem is, how can we be sure it’s not a permanent loss? The truth is that we can’t be sure so all we can do is look at history. History shows that over the last 150 years every single sell-off has been temporary. New highs have always been made following losses and the end result has been that relentless 10% CAGR we’re chasing. We’ll look at historic sell-offs and what to expect in a later post but for now, let’s just repeat that over the last 150 years, every single sell-off has been temporary.

So, in the short-term the main driver of risk will be volatility and there will be times when it’s painful. These temporary losses are the short-term price we will have to pay to be able to earn that 10% CAGR in the long-term. Luckily we’re not investing for the short-term, we’re investing for 80 – 120 years so let’s look at what our risk is in the long-term.

Risk in the Long-Term (over 10 years)

In post “1.4 Inflation, Saving & Investing” we saw that our investments historically needed to beat 4% inflation and that a £13.60 coffee round will be costing £687 in 100 years’ time, a price increase of 5,000%! The relentless 4% grind of inflation slowly kills our spending power but unlike volatility, it’s hidden and out of site. If we suffer a 25% fall in our wealth due to volatility, in the context of our coffee being 5,000% more expensive it doesn’t matter, we were never going to be able to afford a coffee anyway!

To overcome the risk of inflation we can harness the power of stock markets. Historically, there is research that shows that US stocks have made a 10% CAGR for the last 150 years and it’s a pretty consistent 10%, decade in, decade out. Let’s just stop and think about that, 150 years is a huge amount of time. The price of earning this relentless 10% CAGR has been that investors have had to accept volatility in the short-term.

We’re investing in funds and indexes run by professionals which are invested in 100’s of companies in dozens of industries and we’re seeking that 10% CAGR. Of course, there’s no certainty that the future will be like the past but we’re not going to bet against 150 years of history. We really can’t emphasise enough how in the long-term, the main driver of risk is inflation and this is what we need to focus on.

SUMMARY

Volatility is usually misunderstood as being risk. In the short-term yes, it can lead to risk, but in the long-term it is inflation that’s the real risk and there is 150 years of history to confirm this.

Our risk is that we won’t be able to afford to buy all the things we want in the future. To stop this from happening we must have the fundamentals in place: we must save; we must resist the temptation to spend; and we must follow a plan that reduces the risk of a permanent loss as much as possible.

In the long-term, it has historically been inflation that’s caused our risk to materialise but it’s been possible to overcome this by earning a 10% CAGR by investing in the stock market. Our investments will be volatile in the short-term and this is price we’ll pay to earn the long-term returns needed to overcome the damaging effects of inflation.

PERSPECTIVE

So, if you’ve been following stock markets this year you will have seen they’ve been volatile and markets are down. We should also note that last year markets we also volatile and were up but for some reason people don’t talk about upside volatility, they just panic when downside volatility strikes. The Crazy Fund has continued to lose money this month as you’ll see later in the post but we want to put current markets into perspective.

We are going to turn a saving of £50pm over 10 years, or a Lumpsum of £10,000, into $1billion over the next 80 – 120 years. That’s a return of 7,700,000%, yes, 7.7million percent! When there is panic in stock markets it’s easy to lose belief in what you are doing and a 25% loss can seem like a mountain to climb. Our mountain is 7,700,000%, not the current sell-off. The Monthly Plan started 16 months ago with no savings and we are building a solid financial base from month to month despite this sell-off and are developing the habits needed to become incredibly wealthy. The Lumpsum Plan is still up despite the sell-off and remember, last year when we were making a lot of money we said it would not continue and we would lose money at some point.

Our journey will see us making new peaks in our wealth only for them disappear in sell-offs like this one and we’ll have to wait for the market to be ready to take us on the next step of our journey to $1billion. We must be patient, stick to our plan and remember our goal. Putting drawdowns into perspective makes us realise that it was never going to be a straight line to 7,700,000%. Every sell-off for the last 150 years has been re-scaled and then new peaks in wealth have come.

If you are new to investing we realise you might find this very hard to understand and very worrying, but once you’ve been through a few sell-offs like the current one you’ll become slightly more battle hardened (but it will still frustrate you!). Hopefully, now that we’ve discussed Risk and Volatility you can put sell-offs into perspective by remembering that volatility is the price we pay for making a 10% CAGR and beating inflation.

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Wed 30-Apr-25 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 157 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 207 | 0 |

| Units last month | 483 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 483 | 10,000 |

| Unit Price £ | 1.1026 | 1.1026 |

| Fund Value £ | 533 | 11,026 |

| Total Wealth £ | 740 | 11,026 |

| FX Rate | 1.3371 | 1.3371 |

| Total Wealth $ | 989 | 14,743 |

| Estimated CAGR | 14.02% | 14.02% |

| Years to $1billion | 93yrs 6mths | 84yrs 9mths |

Another month, another £50 saved on the Monthly Plan and we’ll look to invest our cash in a couple of months. The Lumpsum Plan is doing nothing as usual.

THE CRAZY FUND

| Results | 31-Mar-25 | 30-Apr-25 | MTD Move | YTD Move | LTD Move |

| Unit Price £ | 1.1221 | 1.1026 | (1.74%) | (13.84%) | 10.26% |

| FX Rate | 1.2929 | 1.3371 | 3.42% | 6.85% | 5.10% |

| Unit Price $ | 1.4508 | 1.4743 | 1.63% | (7.94%) | 15.88% |

| CAGR £ | 9.67% | 7.62% | (2.05%) | (20.28%) | 7.62% |

It’s been another hard month for The Crazy Fund but again, the FX rate to see what we’re worth in USD has moved in our favour. None the less, we are down almost (14%) on our investments this year and (8%) when looked at in USD. We’re going through a period of extreme volatility at the moment as the chart shows and at one point this month (Mon 07/Apr) we’d lost all of our returns to date. We only just had our head above water with the unit price at 1.0036 as we bought our units on the Lumpsum Plan at 1.0000 when we started.

Our CAGR has collapsed and so the green line has spiked showing that it’s now going to take longer to reach our goal of $1billion, but still within our 80 – 120 year time estimate. Could it get worse from here? Yes, we have no way of knowing how “temporary” this sell-off will be or how bad.

Below is a table of what the fund is invested in at 30/April:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 10.3% | 345.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 10.2% | 899.80 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.9% | 5,118.50 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 9.7% | 355.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 9.8% | 2,218.50 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 9.5% | 288.50 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 9.7% | 84.42 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.2% | 43,974.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 9.9% | 35,428.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 9.6% | 927.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.8% | ||||

| Cash | 0.2% |

During the month, JAM went ex-dividend and so we have included this dividend in our cash balance , the payment date is at the end of May. Otherwise, there were no changes in the month. See post “1.7 Some Things Companies Do” for a refresher on dividends regarding ex-dividend and payment dates if you need to.

A FAVOUR

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month we’re going to look at indexes in more detail. We keep talking about indexes and in particular the S&P500 but what exactly are they and how do they work? Next month we’ll find out.

*** Please subscribe to our posts using the “Subscribe” box at the top of our website and don’t forget to spread the word!

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

© TradeFloor Promotions Limited 2025