December 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN

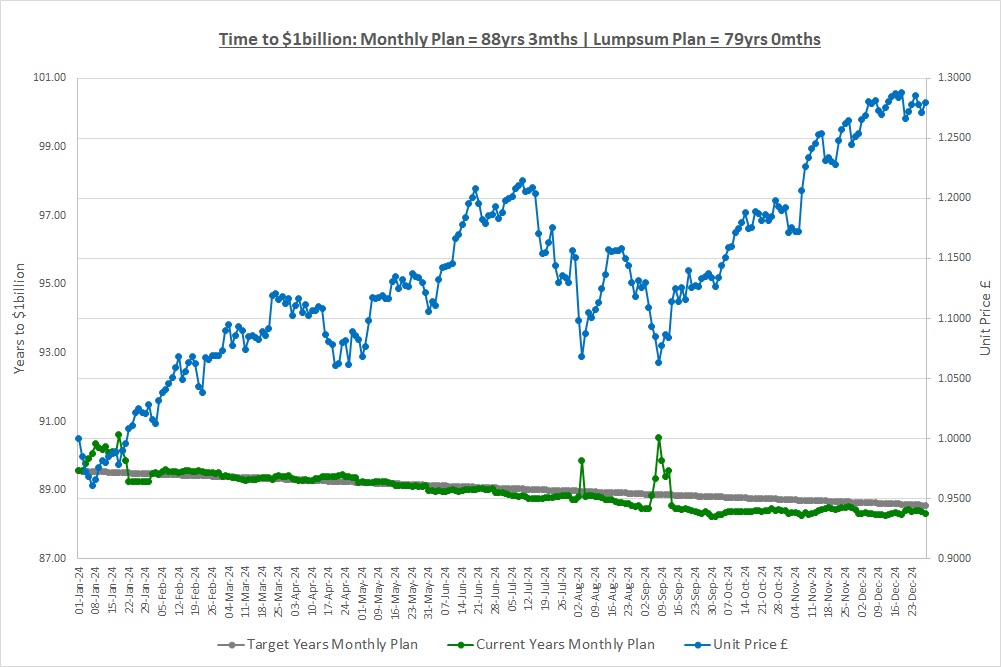

Our Lumpsum Plan will be worth $1billion in: 79yrs

Our Monthly Plan will be worth $1billion in: 88yrs 3mths

Firstly, Happy New Year! We hope you had a wonderful break and thank you for returning to our blog for our second year! Last month we looked at some examples of disasters that have hit investors in single stocks and saw we could lose huge amounts of money or even our entire investment if we get it wrong. We looked at some solutions to try and limit these losses including Diversification and Fixed & Trailing Stop Losses but decided we needed a different plan. A better plan is to Employ a Professional to do all the hard work for us and use Index Investing and we’ll look at these over the coming year.

This month we’re going to revisit our posts from the last year as we’ve covered a lot of information and want to consolidate the most important points. We started the year knowing nothing about stocks and investing and have slowly built our knowledge. We hope you’ve seen that stock markets are not complicated once you know the language.

RESULTS FOR THE YEAR

So where did we end the year? Well, we have to say, it was a very good year:

Monthly Plan: Value = $779 (£623), Years to $1billion = 88yrs 3mth

Lumpsum Plan: Value = $16,013 (£12,796), Years to $1billion = 79yrs

The Crazy Fund: 1yr return = +27.96%

There are two key points to highlight from our first year and the first is concerning the Monthly Plan. A year ago, we had no savings and the financial future looked bleak, but by saving just £50 a month we’ve turned our fortunes around. The power of small, regular saving and investing is remarkable and should not be underestimated. We’re on course to make $1billion and it’s only going to take us 10 years longer than if we started with £10,000 on the Lumpsum Plan. You don’t need a large amount of money to start on a journey to huge wealth, you need a plan and good financial habits. We’ve stuck to our plan month-in month-out and that’s what will lead to success.

The second point to highlight is the return of The Crazy Fund and this affects both the Monthly Plan and the Lumpsum Plan which both own units in it. It’s been an exceptional year and we shouldn’t expect years like this very often, a return of +27.96% is an outlier. If we’d started the year with £1million we would have made £280,000 this year, if we’d started with £100million we would have made £28million and Warren Buffett? He’s now worth around $140billion and has made over $20billion, in a year! The power of compounding is remarkable and one day we’ll be making these amounts of money, we just need to be patient and execute our plan.

Through our regular saving and the returns of The Crazy Fund it has without doubt been a great start and this shows that maybe our plan is not so crazy after all. Looking at our performance we have our first lesson and it’s that we just need to start. Both the Monthly Plan and Lumpsum Plan only had great years because we decided to start.

Lesson #1: We just need to start. We’ll never become wealthy if we never start saving and investing.

KEY LESSONS FROM OUR POSTS

We started off the year dreaming of Ferraris, amazing holidays, first class travel, private jets, helicopters and all those things we don’t have. Rather than just dreaming and hoping it would happen we said we needed a plan and to execute the tasks needed to reach our dream. We used the example of Venus and Serena Williams whose father put together a plan to make them two of the most successful tennis players of all time. Yes, he was laughed at in the early years just like we are when we tell people our crazy plan of making $1billion, but look at the last year. Only one year in and both the Monthly Plan and the Lumpsum Plan are on track.

Lesson #2: Don’t just dream, have a plan to make your dream come true.

When we looked at what defines successful people we saw some common traits regardless of whether we looked at sports stars, business moguls or investing gurus. From Roger Federer, Tiger Woods and Michael Jordan to Bill Gates, Elon Musk and Jeff Bezos to Warren Buffett, they all had a lot in common. They all had to make sacrifices along the way and they all had to commit to their plans and dedicate the time needed in order to achieve success. $1billion isn’t just going to fall into our lap one day, it’s up to us to sacrifice a couple of hours a week and the regular saving or lumpsum that are needed to reach our dream.

Lesson #3 To be wealthy we need to commit to our plan and sacrifice the time needed and £50pm or a lumpsum.

Right at the start we said that one of the biggest risks to realizing our dream is temptation. This is so important that we’ll repeat what we said all those months ago “If we go and blow our £50 per month or find that there isn’t £10,000 down the back of the sofa, then there will never be $100,000. If there is never $100,000, then guess what, there will never be $1million and if there is never $1million, there will never be $1billion.”

We’re constantly bombarded with adverts trying to get us to spend our money but we have to resist these temptations if we want to be wealthy. The irony is that by resisting we’ll eventually generate so much wealth that we’ll be able to have all we dream of and more. We should think of the money we’ve saved as family money, not ours. We are the custodians of our family’s wealth, wealth that will benefit both us and future generations.

Lesson #4: To become truly wealthy, we must resist the temptation to spend.

We estimate it will take 80-120 years to reach $1billion and realise this is rather a long time and we’ll not be around to see the results, but does this mean we shouldn’t start? No, in fact the opposite, it means we should start as soon as we can. Sure, we might not hit $1billion in our lifetime but we have every chance of hitting $1million, $10million or even $25million depending on how young we are. Even these amounts will provide us with a wonderful income in our retirement and lay strong foundations for future generations to reach $1billion. To build a bright financial future we must be patient and think long term.

Lesson #5: Long-Term thinking is the only way to become truly wealthy.

The reason our plan seems crazy to people is that they don’t understand the power of compounding. We dedicated a whole post to the Compound Annual Growth Rate (“CAGR”) as it’s the main reason we can achieve extraordinary wealth. If you remember, compounding means we don’t take any money out (we resist the temptation to spend) and so we get growth on growth. Over very long periods of time we saw it can lead to extraordinary results. Warren Buffett has achieved a CAGR of around 20% which would make the Monthly Plan worth $276billion in 100 years’ time, with a 15% CAGR we’d have $4.6billion and with a 10% CAGR we’d have $65.7million. All these amounts are from just £50 a month for 10 years.

Lesson #6: Compounding leads to extraordinary results over long periods of time.

Unfortunately, we also saw that compounding works against us in a very silent but devasting way in the form of inflation. Inflation, as we all know, is how much things we buy go up in price from year to year and over the last 100 years inflation has averaged 4%pa. This is small from year to year but when it compounds over long periods of time it’s disastrous, our £13.60 coffee round will cost £687 in 100 years which is 50 times what it is now! The three stages of investing showed the reality over 100 years: if we stuff our money under the mattress we just have our £13.60; if we save in a bank account at 3% we end up with £261 but if we invest in the stock market and earn a 10% CAGR we end up with £187,416 and can afford the £687 coffee round! To become wealthier, we have to beat 4% inflation and investing in the stock market has historically been the way to do this.

Lesson #7: Inflation is a destroyer of wealth and so to be wealthier we need to earn a return significantly greater than inflation. The stock market has historically returned a 10% CAGR, comfortably beating the historic 4% inflation.

We then looked at something called a “company” and saw that it’s actually very simple, it’s just a legal structure that allows people to carry out a business. One of the main advantages of a company is limiting personal liability if you remember our croissant slipping customer! Whether it’s selling coffee, phones, social media services, boats, food or anything you can think of, a business can be set up and run as a company. We also saw it made it easier to grow the business as companies can issue shares to new investors to raise money. As a shareholder in the business, you literally own part of the business and the profits of the business belong to you.

Lesson #8: A company is just a way to do business and if you’re a shareholder, you’re a part owner and the company’s profits belong to you.

Companies make and do almost anything you can think of but at the end of the day it’s really simple, they make and sell the goods and services we buy day-in day-out. Most companies start out as Private companies and it’s almost impossible to invest in them. Private companies can go Public by listing on a stock exchange and when they do, anyone can buy shares in the business. Around 100 countries in the world have a stock market and the value of the 50,000 or so companies listed on them is about $100 trillion, a quite staggering amount. The US is the largest stock market being around 50% of the total and no other country comes close.

Lesson #9: You don’t need a PhD to invest in stocks. Stock markets are simply places where you can find companies that sell the everyday goods and services we buy day-in, day-out.

There’s a lot of jargon in the investing world and we talked about companies paying out their profits to shareholders as dividends or using them to buy back their own shares. We saw they can raise money through a rights issue and use share splits and consolidations to manage the share price. We also saw there’s more than one type of share, the most common type being ordinary shares, but preference shares can also be issued.

Each year companies issue an Annual Report and Accounts to shareholders which includes a Profit & Loss Account showing whether the business has made a profit over the year, a Cash Flow Statement showing if the company is burning through or generating cash and a Balance Sheet which is a snap-shot of what the company is worth.

Having all this information, we looked at various investment styles we could use to select stocks to buy including: buy what we Like; Value Investing; Growth Investing; Quality Investing; Momentum Investing and Blending some of these styles together. Even if we choose a style, the pool to fish in is overwhelming with over 50,000 companies on 100 stock markets! It was at this point we said it would take us more than 2 hours a week and we might not be any good at it anyway so we need another plan!

Lesson #10 Investing in single stocks will take more than 2 hours a week and we might not be any good at it anyway.

We then saw that single stock investing can also be extremely damaging to our wealth and we could lose large amounts of money or even our entire investment if we get things wrong. Yes, there are some things we can do to minimise this risk such as Diversification and using Stop Losses, but at the end of the day, single stock investing can result in large losses. As a result, our plan going forward is going to be to Employ a Professional and use Index Investing.

Lesson #11 Investing in single stocks can lead to large losses, a safer option is to Employ a Professional and use Index Investing.

Right at the very beginning we threw ourselves in at the deep-end when we talked about funds and we set up The Crazy Fund. Funds are very simple, they are just a pool of money from lots of investors which the fund manager invests on their behalf. Funds are going to be the fundamental building block of our investing strategy and are what will allow us to Employ a Professional and use Index Investing in a very time-efficient and cost-efficient manner.

Lesson #12: A Fund is just a pool of money from lots of different investors which the fund manager invests on their behalf.

Funds allow us to invest small amounts of money across lots of companies. Even so, when we came to invest the Monthly Plan savings after 6 months we had a problem as some of the share prices were so high that we couldn’t afford to buy them with the amount of money we had. Looking at correlation allowed us to find alternative investments that we could afford that have historically performed almost the same as the investment we really wanted. Remember, correlation doesn’t have to be all mathematical and difficult, we can simply pull up a chart and look at two investments and see if they track each other.

Lesson #13: It’s more than possible to invest small amounts of money and we can use correlation to find alternative investments if we need to.

The final thing from the posts that we want to highlight is currency. This confuses a lot of people but it really is very simple. In our case, The Crazy Fund value is in GBP but a billionaire is measured in USD and so we need to find out how much we are worth in USD. Just like going on holiday, we find the exchange rate for selling GBP and buying USD and use it to see how much we’re worth in USD.

Lesson #14: Currency is really simple, it’s exactly the same as exchanging money to go on holiday.

One thing we want to point out is that over the last year we’ve not commented on the stock market, the news, inflation, gross domestic product, trade flows, exchange rates, wars, politics, environmental disasters, or anything. We’ve just quietly sat back and watched our investments go up and down month-in month-out. We really don’t need to be addicted to the news or the latest trending stock and if we are, it will leave us with no time for research. We know that for over 50 years the S&P500, the 500 largest companies in the US, has relentlessly gone up with a CAGR of 10%. All we need to do is stick to our plan, do our research, sit back and if the future is like the past, we will become billionaires. If this sounds too easy that’s because it is, sometimes it’s the easiest things that are the hardest to do. The hard part is sticking to the plan, resisting temptation and holding our nerve when we lose money, which we will.

Lesson #15: Don’t get caught up in market noise and the news, just ride the bigger wave of a 10% CAGR

We hope this post helps to solidify what we’ve covered over the last year. Believe it or not, that’s all the basics we need regarding single stocks and stock markets and yet if you wanted to, you could go and buy dozens of books on any one of the above topics. We don’t need to know every minute detail to become wealthy, we need the basics and then the commitment to execute our plan. Over the coming months we’re going to explore ways to find Professionals and Indexes to invest in which is exactly what The Crazy Fund owns.

A FAVOUR

Please subscribe to our blog using the “Subscribe” box at the top of our website https://thecrazyplan.com and we would be grateful if you could pass on the link to other like-minded people. We hope to inspire you to set out on your own journey to create a better financial future for you and your family.

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Tue 31-Dec-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 250 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 300 | 0 |

| Units last month | 252 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 252 | 10,000 |

| Unit Price £ | 1.2796 | 1.2796 |

| Fund Value £ | 322 | 12,796 |

| Total Wealth £ | 623 | 12,796 |

| FX Rate | 1.2514 | 1.2514 |

| Total Wealth $ | 779 | 16,013 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 88yrs 3mths | 79yrs 0mths |

We now have £300 of cash saved in the Monthly Plan, how quickly another 6mths have gone by. We’ll look to invest this in The Crazy Fund next month.

THE CRAZY FUND

| Result | 29-Nov-24 | 31-Dec-24 | Move |

| Unit Price £ | 1.2537 | 1.2796 | 2.07% |

| FX Rate | 1.2697 | 1.2514 | (1.45%) |

| Unit Price $ | 1.5918 | 1.6013 | 0.60% |

| CAGR £ | 28.05% | 27.90% | (0.16%) |

Another good month for our investments, making just over 2% but the FX rate to see what we’re worth in USD moved against us so net we were up 0.60% in USD. Those hawk-eyed amongst you will notice we made 27.96% over the year but the CAGR is only 27.90%? This is because when calculating CAGR we assume there are 365.25 days in the year to account for leap years. However, 2024 was a leap year and so there were in fact 366 days in the year!

Below is a table of what the fund is invested in at 31/Dec:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 6.4% | 385.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 8.7% | 955.00 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.3% | 5,417.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.7% | 419.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 9.2% | 2,736.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 8.8% | 348.50 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.8% | 96.48 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.5% | 50,164.50 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.6% | 41,539.50 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 11.7% | 1,130.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.8% | ||||

| Cash | 0.2% |

One of our investments, LON:EQQQ declared and paid a dividend in the month and so our cash balance increased by a very small amount. Otherwise, there were no changes in the month.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month we’re going to take a closer look at The Crazy Fund. One area we’ll look at is that over time, some of our investments have done well and some not so well. As a result, we’ve ended up with different amounts in each and so we’re going to talk about Rebalancing our portfolio so that our money is more evenly invested in each stock.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website https://thecrazyplan.com

© TradeFloor Promotions Limited 2025