November 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN

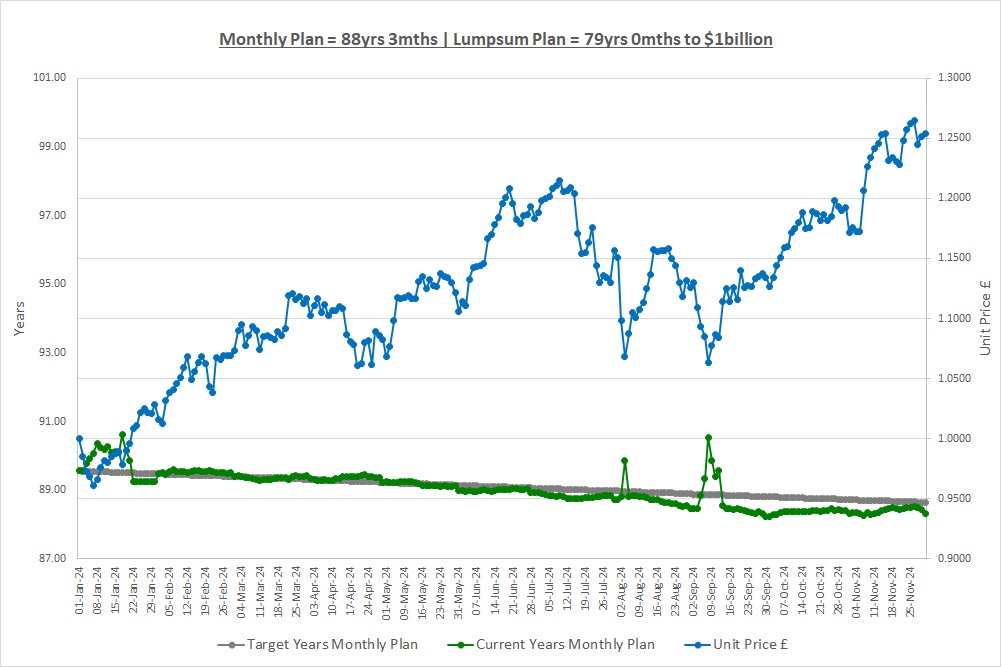

Lumpsum Plan Time to $1billion: 79yrs

Monthly Plan Time to $1billion: 88yrs 3mths

Last month we looked at ways to choose companies such as: buying what we “like”; Value investing; Growth investing; Quality investing; Momentum investing; and Blended styles. We also talked about Black Friday and Christmas shopping and how we must resist the temptation to spend our hard-earned savings. This month we’re going to look at what can go wrong if we buy single stocks and some solutions to overcome the problems we face. Finally, we’ll come up with the foundations of our investment plan.

DISASTERS!

Investing in single stocks can be brutal to your wealth. The following table shows a few “accidents” that have happened and these are just the tip of the iceberg, there are sadly 100’s more examples. The table shows the value of £10,000 if we’d invested just before the crashes:

| Company | Share Price | Period of Time | Loss | £10,000 |

| AVON | 3,643p to 920p | 1¾ years | loss > 75% | < £2,500 |

| BT | 496p to 98p | 5 years | loss > 80% | < £2,000 |

| CCL | 3,700p to 600p | 3 months | loss > 80% | < £2,000 |

| ESL | 92p to 6p | 9 months | loss > 90% | < £1,000 |

| EZJ | 1,550p to 475p | 3 months | loss > 70% | < £3,000 |

| HSBC | 791p to 283 | 2½ years | loss > 65% | < £3,500 |

| MADE | 210p to 3p | 1¼ years | loss > 95% | < £500 |

| MTRO | 4,000p to 60p | 2½ years | loss > 98% | < £200 |

| NOKIA | 62p to 1.5p | 12 years | loss > 95% | < £500 |

| RR | 1,094 to 133p | 2¼ years | loss > 85% | < £1,500 |

Some of these companies didn’t survive and we would have gone on to lose all our money, but even if they did survive it can take years to recover from losses of this size. The funny thing is, just before they collapsed there were people that loved these companies and thought they were “incredible Growth stories” or “amazing Quality investments”, until they weren’t. Interestingly, they were probably not “great Value” as Value investing often sees through the hype.

The table is shocking for the obvious reason that the amount of money lost is colossal. Don’t think this only happens to small companies, there are big names in here like the banking giant HSBC, the mobile phone maker Nokia that was the darling of its time and Rolls Royce whose engines power the global aeroplane fleet. Just because a company is big and well known doesn’t make it immune to huge losses. Some losses are death by a thousand cuts taking years to slowly destroy wealth whilst others are very quick sell offs.

No matter how much research we do we’ll always run the risk of serious loss and one example is the devastation of Covid when people stopped flying, causing the RR loss. There’s also the issue of fraud, we would have lost all our money if we’d invested in the “incredible” stock Enron (not in the table) which turned out to be a complete fraud. There’s not much more we want to say other than look at the table again, investing in single stocks can be truly damaging to our wealth.

PROBLEMS & SOLUTIONS

So, now we’ve seen some disasters we can add this to our list of problems which are:

- How to pick stocks: How will we really use the accounts and investment styles in practice?

- Will we be any good: Will we be that 1 in a few thousand who’s successful?

- Time: Can this be done in a couple of hours a week?

- Disasters: How do we avoid these?

Let’s look at a few things that might help, apart from giving up (and you know what we think about that as a solution).

Diversification

We’re sure you know the saying “don’t put all your eggs in one basket”, well it’s no different in investing and owning more than one stock is called having a portfolio. Say we invest £10,000, if we buy one stock and lose 90% of our money that’s a £9,000 loss. If instead we buy ten stocks in equal amounts of £1,000 each, if one of these ten loses 90% we’ll lose £900 on that stock and our portfolio will be worth £9,100 (assuming the other 9 stocks are still worth £1,000 each). This is a 9% loss overall, a far better result.

How many stocks is the right number, 10, 20 or 30? There’s no real answer but some research suggests the number is higher than people think, perhaps 40-60 stocks. The more stocks we own though the more chances of owning a disaster, so we may end up with 2 or 3 disasters not one but this should still be better than losing 90% on a single stock.

Just to confuse us, some investors say you should put all your eggs in one basket and then watch that basket. The greatest investor of all, Warren Buffett, said “You know, we think diversification – as practiced generally – makes very little sense for anyone that knows what they’re doing… it is a protection against ignorance.” You can’t deny he could have a point, he’s worth over $140billion.

Fixed Stop Loss

Setting a “Fixed Stop Loss” means selling our shares when we’ve lost a certain amount of our initial investment. We could say that when we lose 10% of our money we’ll sell the stock, take the loss and move on to the next investment. Say we buy £1,000 of a stock and pay £1 per share, we could set a Fixed Stop Loss of 10% which means if the share price goes down through 90p (£1 purchase price less 10% we’re prepared to lose) we’ll sell the stock and take the loss. The loss will be £100 and this is far better than the £900 loss we would face if we kept the stock and “hoped” it would come back.

Trailing Stop Loss

A Fixed Stop Loss sounds good but there’s one problem. If the stock doubles to £2 per share our investment is worth £2,000. If the share price then goes all the way back to our stop at 90p we’ll lose our £1,000 of profit plus the £100 from the stop, a total loss of £1,100 . This is a 55% loss from our peak wealth of £2,000 even though it’s still only a 10% loss from our initial investment.

Giving back profits doesn’t sound good so instead we could use a “Trailing Stop Loss”. This means we move our stop up as the share price moves up but we never move it back down. So, we set the stop at 90p but if the share price hits £1.50 we move the stop up to £1.35 (£1.50 high price less 10% we’re prepared to lose), if it hits £2 we move it up to £1.80 etc. Now, when the share price goes down to £1.80 we sell our shares as we’ve “trailed” the stop up. This means we only lose £200 (10% of our peak wealth) which is far better than the £1,100 loss.

In reality the stock might go down more than 10% before we’re able to sell and we could lose more than 10%. The difference between our stop of £1.80 and where we actually sell our shares, say £1.70, is called “slippage”. For a big company with lots of shares being traded on a normal day you may have almost no slippage. For a small company who’s shares hardly trade with a stock market that’s selling off then slippage can be large.

SINGLE STOCK INVESTING IS NOT FOR US

So, both Diversification and a Trailing Stop Loss look like they’ll help with the problem of “Disasters” but we’re still left with the first three problems of how to pick stocks, will we be any good and the huge amount of time it’s going to take. At this stage therefore, as we start out, we don’t think investing in single stocks is an option as it will have too much uncertainty. We need another plan that overcomes all four of our problems so what can we do?

Employ a Professional

A post or two ago we said professional investment managers on average make an average CAGR. This doesn’t mean that all professional investors are average though, clearly some will do better than average and some will do worse and so all we need to do is find the good managers (if only it was that easy!).

If we think about what we’ve learnt so far then good managers will know all about: Accounts; Value investing; Growth investing; Quality investing; Blended styles; Diversification; and Stop Losses. They’ll employ lots of people to do all this who’ll work full time and should be far more likely to produce a good CAGR than just us, on our own, doing a couple of hours of research a week. Finding a good investment manager then looks like a good idea.

Index Investing

Over the last few months, we’ve kept referring to the S&P500 and that magic 10% CAGR it’s made for the last 50+ years. The S&P500 is what’s called an “Index” of the 500 largest companies in the US and all an Index is is a single number to represent all 500 companies. There hundreds if not thousands of Indexes and every stock market will have dozens that we can use to help keep track of that market. There are also indexes that might track the Information Technology sector, the Pharmaceutical sector, Value stocks or Growth stocks and there are World indexes tracking global stock markets.

The great thing about indexes is that there are some very easy ways we can invest in some of them. Take the S&P500 index as an example, a few years ago if you wanted to buy the S&P500 you would literally have had to buy all 500 companies in the index, now that would be a lot of work! Nowadays, all we have to do is make one investment and someone else will do all the work for us and we like the sound of that! So, Index investing also sounds like it might be a good idea.

OUR PLAN – AT LAST!

Instead of investing in single stocks, why don’t we “Employ a Professional” and use “Index Investing”? This strategy should overcome all four of our problems since we won’t have to worry about how to pick stocks or whether we’ll be any good at it, it can be done in a couple of hours a week and we can forget those disasters (probably). We can also Diversify across professional managers and Index investments and maybe look at using Stop Losses as well later on when we’re up and running.

So, why-on-earth have we spent 11 months talking about investing in single stocks? Well, we’re still going to effectively own single stocks it’s just that we’re going to get someone else to do the work for us. It’s therefore vital that we know what investing in stocks is all about as one of the biggest reasons for our success, if you remember, is going to be our ability to stick to our plan. If we hadn’t spent the last few months learning what investing is we’ll never be able to stick to our plan in the bad times. We’ve shown that investing, done properly, is not gambling but is owning parts of businesses and their profits, businesses that sell us goods and services day in, day out like coffee. We now have the basis of our plan, onwards to $1billion!

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Fri 29-Nov-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 200 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 250 | 0 |

| Units last month | 252 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 252 | 10,000 |

| Unit Price £ | 1.2537 | 1.2537 |

| Fund Value £ | 316 | 12,537 |

| Total Wealth £ | 566 | 12,537 |

| FX Rate | 1.2697 | 1.2697 |

| Total Wealth $ | 719 | 15,918 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 88yrs 3mths | 79yrs 0mths |

The Monthly Plan is really coming together after 11 months of saving. The Lumpsum Plan is also on track and has had a great run, it’s now 79 years until we hit the magic $1billion but we’ll not get too excited as there will be some very large set-backs in the future but what a great start.

THE CRAZY FUND

| Result | 31-Oct-24 | 29-Nov-24 | Move |

| Unit Price £ | 1.1719 | 1.2537 | 6.99% |

| FX Rate | 1.2960 | 1.2697 | (2.03%) |

| Unit Price $ | 1.5188 | 1.5918 | 4.81% |

| CAGR £ | 20.92% | 28.05% | 7.13% |

A good month with The Crazy Fund making 7%. The FX rate to see how much we’re worth in USD moved against us and offset some of these gains but we still ended up almost 5% over the month.

Below is a table of what the fund is invested in at 29/November:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 6.3% | 376.50 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 8.8% | 942.80 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.6% | 5,456.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.4% | 397.50 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 9.0% | 2,626.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 8.7% | 336.00 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.7% | 94.60 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.8% | 50,332.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.5% | 40,309.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 12.0% | 1,140.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.8% | ||||

| Cash | 0.2% |

During the month one of our investments, LON:SMT, went ex-dividend. We’ve included this amount in the value of our Cash balance and we’ll receive the dividend in December.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month is our first anniversary and so we’re going to do a review of the year to highlight some of the most important points we’ve discussed. Thank you for following us for the last 11 months, all that remains this month is to wish you and your families a wonderful Christmas and a very Happy New Year, enjoy!

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website https://thecrazyplan.com

© TradeFloor Promotions Limited 2024