October 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN

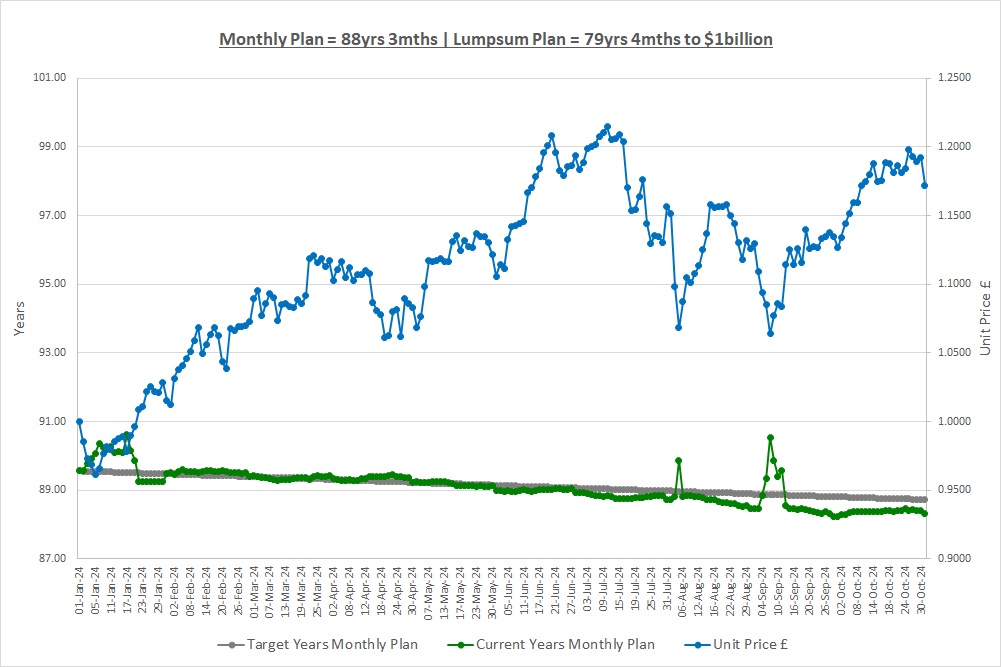

Time to $1billion: Monthly Plan 88yrs 3mths | Lumpsum Plan 79yrs 4mths

Last month we looked at Accounts which include the Profit & Loss Account which shows if a company is selling goods or services for more than they cost to make, the Cash Flow Statement which shows if a company is running out of cash and the Balance Sheet which shows the value of everything a company owns and owes to other people. This month we’re going to look at how we can use this information to pick tomorrow’s winning companies and avoid the losers. First though, Black Friday and Christmas are just around the corner…

BLACK FRIDAY, CHRISTMAS & OTHER EXCUSES TO SPEND MONEY

Back in post “1.2 Sacrifice, Temptation & Commitment” we talked about what it’s going to take to make our family billionaires. We said one of the most important things will be “whether or not we can resist the temptation to spend the money” and two big temptations are looming.

Our Monthly Plan is now worth £496 ($642) and the Lumpsum Plan £11,719 ($15,188). As Black Friday sales and Christmas approach there’s a real temptation to dip into these funds and to skip saving into the Monthly Plan. However, no matter how hard it is, we have to resist this temptation and that includes loading up the credit cards. If we feel under pressure to buy “stuff” the best approach is to have a conversation with our family and tell them we’re on The Crazy Plan, we’re finally living within our means and we’re saving for a brighter future.

Our commitment to this plan is going to be tested and we must not throw away all we’ve achieved over the last 10 months. Remember, “if we go and blow our £50 per month or find that there isn’t £10,000 down the back of the sofa, then there will never be $100,000. If there is never $100,000, then guess what, there will never be $1million and if there is never $1million, there will never be $1billion.”

CHOOSING COMPANIES TO INVEST IN.

One of the keys to investing is being consistent and to do that we need to have a method for finding the best companies out there so we can make money from their share prices going up and any dividends they pay. Luckily for us there are some well-known methods called investing “Styles” so we’ll have a look at some of these as there’s no point re-inventing the wheel.

BUY WHAT WE “LIKE”

One approach is to read the papers, investment journals and finance websites and then buy the stocks we like the most. Come on, how hard can it be? Sadly, history shows this will be disastrous for our wealth, we stand next to no chance of making consistent money over the long run no matter how confident we might be. Sure, if we take thousands of people who all try this then one of them will be good but we can’t build our investment plan on the “hope” that we’re that one person.

Here’s another idea, why don’t we buy what someone else likes? We could read chat rooms and buy what these random people we’ve never met think is going to make us billionaires by Sunday? Unfortunately, this will probably be even more damaging to our wealth and yet bizarrely this is what a lot of people do. Again, one or two of these thousands of bloggers will be good but our chance of finding them is small and what if they stop posting? We need a better approach.

VALUE INVESTING

One of the best-known and oldest investing styles is called Value Investing which uses a set of factors to try and find stocks that are significantly underpriced. If we buy them, wait until they move up in price and are fairly valued and then sell them, we should make good profits. That certain investor we keep mentioning worth $140 billion (he’s worth $20 billion more than last time), Warren Buffett, places a lot of importance on value and at the end of the day, why would you want to overpay for something?

An example of a factor is something called the Price/Earnings ratio (“PE ratio”). This is simply the Share Price divided by the EPS (from the Profit & Loss Account). If you remember, EPS is earnings per share which is the profit after tax divided by the number of shares in issue. The EPS of our coffee shop last month was 50p and let’s randomly say the share price is 500p, this gives us a PE ratio of 10 (500p / 50p earnings). In other words, it will take the company 10 years to earn back in profits the price we pay for a share. Sometimes the PE ratio might be flipped upside down and you’ll hear a company has an earnings yield of 10% (50p earnings / 500p).

If there’s another company with EPS of 75p and a share price of 1,500p then its PE ratio is 20 (1,500p / 75p earnings). This looks to be less of a bargain than our coffee shop as it will take 20 years for the company to earn back in profits the price we pay for a share. So, a lower positive PE ratio represents more value and the beauty is we can compare PE ratios across companies as they are standardised to the share price.

What if a PE ratio is negative? In post “1.5 Companies, Shares and Stocks” we said owning shares means we have limited liability and this means the share price can’t go negative as if it did, we would owe money. If the share price can’t go negative then a negative PE ratio means the Earnings of the company must be negative, in other words the company made a loss, not a profit. A value investor will tend to stay away from loss making companies.

GROWTH INVESTING

This style looks for companies with really strong growth but growth in what? Growth investing often focuses on newer companies (think Amazon 20 years ago) and they often aren’t profitable or very profitable yet. Investors therefore might focus on growth in Sales (from the Profit & Loss Account), “hoping” the company will eventually turn those sales into profits. If you buy enough companies and find an Amazon, it will more than make up for the losses on the companies that go bust. Growth in sales might look at growth over the last 5 years and investors will want to see extremely high and consistent growth, say 20% or more every year for the last 5 years.

For slightly more mature companies that are making a profit we could also look at EPS growth over the last 5 years. If a company is growing its earnings year in year out at a high rate as well then that has to be good for shareholders.

Typically, a company that shows high growth characteristics will not look great to value investors as the PE ratio is often really high. If a company is not making, or is making very small profits, the PE ratio could be 60, 70, 80 or even higher on the expectation (hope!) that profits will eventually arrive.

QUALITY INVESTING

Quality investing seeks to find strong, reliable companies. We might look at the liabilities a company has (from the Balance Sheet) and avoid companies with lots of debt. We might look at the consistency of EPS and avoid companies that are profitable one year but loss-making the next. We might look at how well a company is using its assets (things they own like the tables, chairs and coffee machine from the Balance Sheet) as if it doesn’t need many assets to make a profit then it can grow more quickly or pay profits out to shareholders. We might also look at cashflow (from the Cashflow Statement) and avoid companies that are running out of cash. So the Quality style looks for solid, reliable companies and whilst they might not give us rocket-fuelled returns, investing in them shouldn’t give us too many nasty surprises either (in theory!).

MOMENTUM INVESTING

This style completely ignores all the information in the accounts and simply says buy the stocks whose share price is up the most over the last year (or 3 months, or 6 months etc). For example, we could take all the companies in the FTSE100 (these are the biggest 100 companies listed on the London Stock Exchange) and buy shares in the 20 whose share prices are up the most over the last year. If this sounds like a crazy idea then wait until you hear the results, it works! We won’t go into the why’s at the moment other than to say it picks-up on two very important aspects of stock markets, namely, investor psychology (& emotion) and the fact that over the very long run share prices just go up relentlessly. It’s a bit of a leap of faith though and a very noisy ride.

BLENDED STYLES

Blended styles might use bits of all the styles we’ve looked at so far so we could pick companies that are: great “Value”; “Growing” the most; the highest “Quality” we can find; and seeing the greatest “Momentum”. Bingo, rich by Christmas! While this sounds like a great idea, and it is, the problem is that these companies will be very few and far between and we really will be trying to find a needle in a haystack. However, looking at companies across different styles can be a good way to rule out companies trading at extremes before then focusing on one style in more detail.

WHAT POOL TO FISH IN

Another thing we need to consider is the pool of shares we’re going to fish in. In post “1.6 Stock Markets” we saw that world stock markets comprise of over 50,000 companies worth $100 trillion with the US being around 50% of this so where-on-earth do we start? Clearly the US should be a great place to find exceptional companies and indeed it is, but there are also exceptional companies listed in other countries and shouldn’t we include them? This is honestly looking like a nightmare.

There’s also another problem, how many stocks should we buy? Should we put all our money into the best stock we find from our research or should we buy several? Next month we’ll look at some investing disasters and see that buying one stock probably isn’t a good idea but how many should we buy?

PULLING IT ALL TOGETHER (OR NOT!)

If we do decide to use some of the above investing styles then there are huge amounts of information we can use from the accounts and dozens of ratios we can calculate to find the best value, growth or quality companies. In fact, there are so many that it could give us a headache if we haven’t got one already! If this month’s post has left you with more questions than answers we’re not surprised. This whole investing thing really is starting to look like a huge task and not the 2 hours a week of work we’re aiming for.

Then there’s the issue of whether we’re actually capable of doing all of this even if we can find the time, will we be that one person who’s successful out of the thousands that try? Bear this in mind too, professional investors who manage other people’s money employ dozens if not hundreds of people with all sorts of fancy degrees and on average their CAGRs are, well, average. If professionals only make average CAGRs then what chance do we stand of doing better? The answer is not much!

We need to find something that’s far easier, more reliable and can easily be handed over to the next generation. Luckily, we have an idea that’s exactly those things and a lot less work than all this “Accounts” and investing “Styles” stuff. So why talk about all this if we’re not going to use it? Well, if we don’t understand all these building blocks of investing, if we don’t understand what we’re actually investing in, then over the decades ahead it will be impossible to stick to our plan and sticking to our plan is going to be one of the keys to success. Oh, one last thing, don’t forget we must resist Black Friday and Christmas shopping, just think of the presents $1billion will buy…

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Thu 31-Oct-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 150 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 200 | 0 |

| Units last month | 252 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 252 | 10,000 |

| Unit Price £ | 1.1719 | 1.1719 |

| Fund Value £ | 295 | 11,719 |

| Total Wealth £ | 496 | 11,719 |

| FX Rate | 1.2960 | 1.2960 |

| Total Wealth $ | 642 | 15,188 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 88yrs 3mths | 79yrs 4mths |

THE CRAZY FUND

| Result | 30-Sep-24 | 31-Oct-24 | Move |

| Unit Price £ | 1.1344 | 1.1719 | 3.31% |

| FX Rate | 1.3383 | 1.2960 | (3.17%) |

| Unit Price $ | 1.5182 | 1.5188 | 0.05% |

| CAGR £ | 18.31% | 20.92% | 2.61% |

Our investments recovered by just over 3% during the month after a tough couple of months. Unfortunately, the FX rate moved against us and all-but wiped out our investment returns. Remember, it’s just noise and nothing more.

Below is a table of what the fund is invested in at 31/Oct.

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 7.0% | 386.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 8.6% | 867.00 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.8% | 5,180.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.1% | 364.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 9.2% | 2,485.50 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 8.6% | 310.50 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.7% | 90.15 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.8% | 47,111.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.6% | 37,919.50 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 11.5% | 1,020.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.8% | ||||

| Cash | 0.2% |

We had a quiet month with no changes in investments and no dividends were declared by any of our holdings.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month we’re going to take a look at what can go wrong when we try and pick stocks to invest in. We’ll also start to have a think about what we can do to overcome the problems we’ll see. Buckle up for some stomach-churning losses!

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website website https://thecrazyplan.com

© TradeFloor Promotions Limited 2024