August 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN!

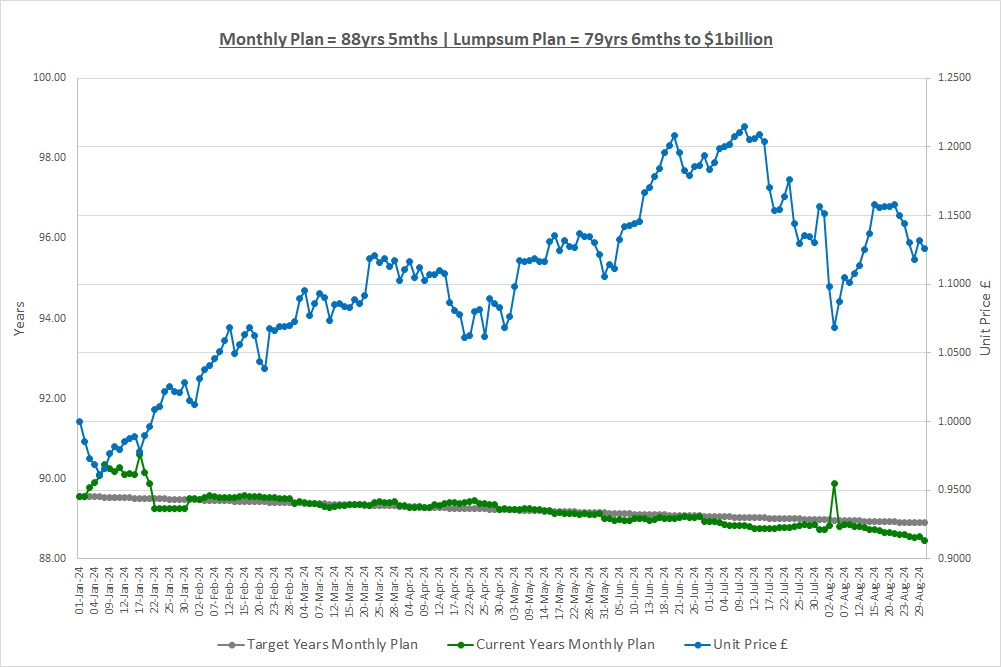

Time to $1billion: Monthly Plan 88yrs 5mths | Lumpsum Plan 79yrs 6mths

Last month we talked about some things companies do that we might come across including: returning profits to shareholders through Cash & Scrip Dividends and Share Buy Backs; managing the share price with Share Splits and Consolidations; raising money with Rights Issues; different types of shares like Ordinary and Preference shares; and the controversial issue around voting rights. Finally, we looked at reporting to shareholders with the Annual Report & Accounts and the Annual General Meeting. This month we’re going to talk about investing small amounts of money but first we’re going to take a quick look at something called correlation.

CORRELATION

Correlation is just a fancy word for whether the changes in two things are linked. Think about ice cream sales and the outside temperature, correlation asks “Do ice cream sales depend on the temperature?” They do, if the temperature goes up then ice cream sales go up so we say ice cream sales are positively (they move in the same direction) correlated to temperature. If ice cream sales always move in the same direction as temperature and by the same amount then they are perfectly correlated and have a correlation of +100%

What about body fat and time spent running? Well, if you spend more time running then body fat goes down so they are negatively (they move in the opposite direction) correlated. If body fat always goes down when you spend more time running and by the same amount then we say they are perfectly negatively correlated and have a correlation of -100% (negative).

In reality things are usually somewhere in between and things are not perfectly correlated. If ice cream sales usually, but not always, go up as the temperature goes up but don’t go up by the same amount then the correlation might be +70%.

Finally, if two things have no link at all but move randomly in relation to each other then they have zero correlation. So, does the price of your coffee depend on the colour of your shirt? No, it doesn’t matter what colour shirt you wear it will not alter the price you pay for your coffee.

Correlation in the stock market is exactly the same, if share A and share B usually move in the same direction then they are positively correlated and if they usually move in the opposite direction, they are negatively correlated.

There’s a lot of fancy maths used to calculate correlation but we’re not going to go into that for now, we just need to know that correlation is either Positive, Negative or Zero and lies somewhere between +100% and -100%

THE PROBLEM

Last month was the first time the Monthly Plan invested in the stock market by buying units in The Crazy Fund. If you don’t have your own Crazy Fund we saw there was a problem as we only had £300 to invest across 10 investments which was around £30 per investment. CSP1, which The Crazy Fund owns, had a price of £455 so £30 wasn’t even close to what we needed to buy it. Let’s take a look at some options we could research to overcome this problem of investing small amounts.

DO NOTHING

This is what most people do, especially when it comes to their finances and investing. We could give up and say this just proves that investing is for people who are already rich like those on the Lumpsum Plan. The thing is, making our family $1billion is not going to be easy and this is our first hurdle. We’ve committed to this plan and are earning $107,158 per hour if you remember so we better come up with some ideas, fast!

WAIT

We could wait until we’ve saved enough money to invest in the same portfolio as the Crazy Fund. The most expensive share is CSP1 so we’ll need around 10 times this to be able to invest in all 10 investments which is £4,550. It will take roughly another 7 years saving £50 a month to save this but when we get there, it’s likely the share price of CSP1 will be even higher so we’ll have to keep saving! It looks like waiting is not a great option but it is, none the less, an option.

INVEST IN ONE SHARE

A while ago in our post “1.3 CAGR & Crazy Plans” we said the US stock market has returned around 10% CAGR for last 50 years. CSP1 tracks the biggest 500 companies in the US and so would be a great starting investment except we only have £300 when we need £455. Now that we know all about correlation, why don’t we look for an investment that we can actually afford that’s highly correlated to CSP1? Have a look at the following chart which shows JAM, which The Crazy Fund also owns, alongside CSP1.

We have reset both investments to start with a price of 1 so we can compare how they have performed over 10 years. Neither of the investments includes dividends so it’s not a perfect comparison but it’s good enough. A really important point here is that you don’t need to be a maths genius who knows how to calculate correlation, you simply need to be able to pull up a chart and look at the prices.

We can clearly see that JAM and CSP1 are very highly correlated and it turns out the above prices have a correlation of +99.4% which is as close to perfect correlation as you can get. Over the entire 10 years, £1 would have grown to £4.11 (15.2% CAGR) if invested in CSP1 or £3.76 in JAM (14.2% CAGR).

JAM had a share price of £9.84 and so we could have bought 30 shares spending £295.20 in total. Then, in another few months when we’re looking to invest our next £300, we can choose another investment and slowly build our portfolio this way. Buying 1 investment is an option and it’s simple.

BUY WHAT YOU CAN

Below is a table of the investments The Crazy Fund held on 01/Jul when the Monthly Plan bought its units. All share prices are in £ and we used the FX rate on that day to convert XDWT from $ to £. There is also a new portfolio listed that only invests in 7 of them.

| Ticker | Price £ | Shares | Cost £ | % |

| LON:IEM | 3.84 | 11 | 42.19 | 14.1% |

| LON:SMT | 8.86 | 5 | 44.32 | 14.8% |

| LON:XDEM | 51.77 | 1 | 51.77 | 17.3% |

| LON:ATT | 3.91 | 10 | 39.05 | 13.0% |

| LON:IITU | 25.25 | 2 | 50.50 | 16.8% |

| LON:PCT | 32.70 | 1 | 32.70 | 10.9% |

| LON:XDWT | 71.24 | 0 | 0.00 | 0.0% |

| LON:CSP1 | 456.03 | 0 | 0.00 | 0.0% |

| LON:EQQQ | 381.37 | 0 | 0.00 | 0.0% |

| LON:JAM | 9.84 | 4 | 39.36 | 13.1% |

| Total | 299.88 | 100% |

The new portfolio buys the investments we can afford and we’ve chosen 7 which works out at around £43 per investment (£300 to invest / 7). The table is hopefully clear, we buy 11 shares of IEM spending £42.19 and the investment would be 14.1% of our total portfolio value of £300. In total we end up spending £299.88.

In a few months’ time when we have another £300, we could buy XDWT and use what’s left to top up some of the above investments. We have no chance of investing in CSP1 or EQQQ for a long while as we just saw but that doesn’t matter, we can start to build our portfolio.

FRACTIONAL SHARES

As we know, a share is the smallest unit of ownership in a company but we want to only buy part of a share, we want to invest £30 in CSP1 which has a price of £455 so we want to buy 0.07 of a share (£30 / £455). Some stock brokers and platforms let you buy fractional shares, they pool all the investors together, buy the total shares needed and then divide them up among the investors. We’ve not explored fractional shares further but you could do some research if it sounds appealing but the number of stock brokers offering this service is small and you might have to pay higher fees for the service.

DIFFERENT INVESTMENTS

Maybe you decide you don’t like any of the investments The Crazy Fund owns and have found other investments when doing your research and you want to buy those. Maybe you decide to own 2 or 3 of The Crazy Fund investments and will add another 2 or 3 when you’ve saved another £300. Maybe you want to own 2 or 3 of The Crazy Fund investments and 2 or 3 you’ve found from your research. Maybe you want to stay in cash and wait until you invest your £300. It’s up to you do your research and come up with something that works for you.

SUMMARY

This blog is not able to tell you how to become billionaires, it’s about giving you the tools you need to allow you to progress on your journey and overcome the obstacles that will always arise. A great tool we’ve used this month is to think about how investments are correlated and we’ve seen that we can choose different investments and get more or less the same result (JAM v CSP1). Investing is more than possible with small amounts of money, we just need to do some research, think outside the box a little and hunt for correlated investments that are affordable if we find something that’s out of our reach.

Also bear in mind that The Crazy Fund will not be the best set of investments for reaching our goal of $1billion. There’s no “perfect” portfolio, only with hindsight will we know what the perfect portfolio would have been. When we look back in 20 – 30 years’ time we guarantee there will be another portfolio or investment that will have had better returns than The Crazy Fund. Who knows, it might be the “Buy What You Can” portfolio above and so you’ll beat us to $1billion!

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Fri 30-Aug-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 50 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 100 | 0 |

| Units last month | 252 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 252 | 10,000 |

| Unit Price £ | 1.1261 | 1.1261 |

| Fund Value £ | 284 | 11,261 |

| Total Wealth £ | 384 | 11,261 |

| FX Rate | 1.3166 | 1.3166 |

| Total Wealth $ | 506 | 14,826 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 88yrs 5mths | 79yrs 6mths |

Another month and another £50 saved into the Monthly Plan, we’ve developed a great habit of saving and our wealth is slowly building from month to month.

THE CRAZY FUND

| Result | 31-Jul-24 | 30-Aug-24 | Move |

| Unit Price £ | 1.1566 | 1.1261 | (2.64%) |

| FX Rate | 1.2836 | 1.3166 | 2.58% |

| Unit Price $ | 1.4846 | 1.4826 | (0.14%) |

| CAGR £ | 28.34% | 19.54% | (8.79%) |

Our investments lost money again this month, being down over 2.5%, but the FX rate to see how much we’re worth in USD came to our rescue so our wealth in USD hardly changed over the month.

If you look at the green line in the chart which is how long the Monthly Plan will take to reach $1billion, you can see there’s an odd jump on 5th August (and jumps in January too that we ignored at the time). So, what’s happening? It’s to do with our assumption of a 15% CAGR for our investing returns over the next 80+ years. In a few years’ time, if we’ve only achieved a 10% CAGR then 10% will be a more realistic assumption to use for our returns going forward.

Currently we don’t have much history to go on as we’ve only been investing since January but on 5th August the unit price of the Crazy Fund hit a low of 1.0683. As a result, we used an estimate lower than 15% to partially reflect our actual performance. Using a lower CAGR means it will take longer to reach our goal of $1billion and so we see the jump in the green line. The unit price recovered from this low and so we’re now back to using a 15% CAGR estimate again.

We’ll not go in to how we calculate our estimate right now other than to say it’s a blend of what we’ve historically achieved and 15%. CAGR has a big impact and will be the main driving factor in how long it takes to reach $1billion, not how much we save.

Below is a table of what the fund is invested in at 30/August

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 7.3% | 391.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 8.6% | 828.00 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.8% | 4,991.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.1% | 346.50 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 9.1% | 2,373.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 8.5% | 2,960.00 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.7% | 88.43 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.7% | 45,038.50 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.5% | 36,139.50 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 11.5% | 977.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.8% | ||||

| Cash | 0.2% |

This month we received dividends from two of our investments, IEM and JAM. Actually, that’s not quite what happened, IEM and JAM went Ex-Dividend. If you remember from last month, Ex-Dividend means we’re entitled to the dividends if we owned the shares the day before the Ex-Dividend Date, which we did. Neither of the shares have paid us the cash yet, we’ll receive that in the coming weeks on the respective Payment Dates, but we’ve included the dividends in our Cash balance.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

We’re now at the point that we can start to think about how we can choose which companies to invest in. To do that it would be good if we knew a little more about the underlying business a company runs, things like how profitable is it, does it have a large amount of debt, it is running out of cash? Next month we’re therefore going to take a quick look at Accounts which are where we can hopefully find the information we need.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website https://thecrazyplan.com

© TradeFloor Promotions Limited 2024