July 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN!

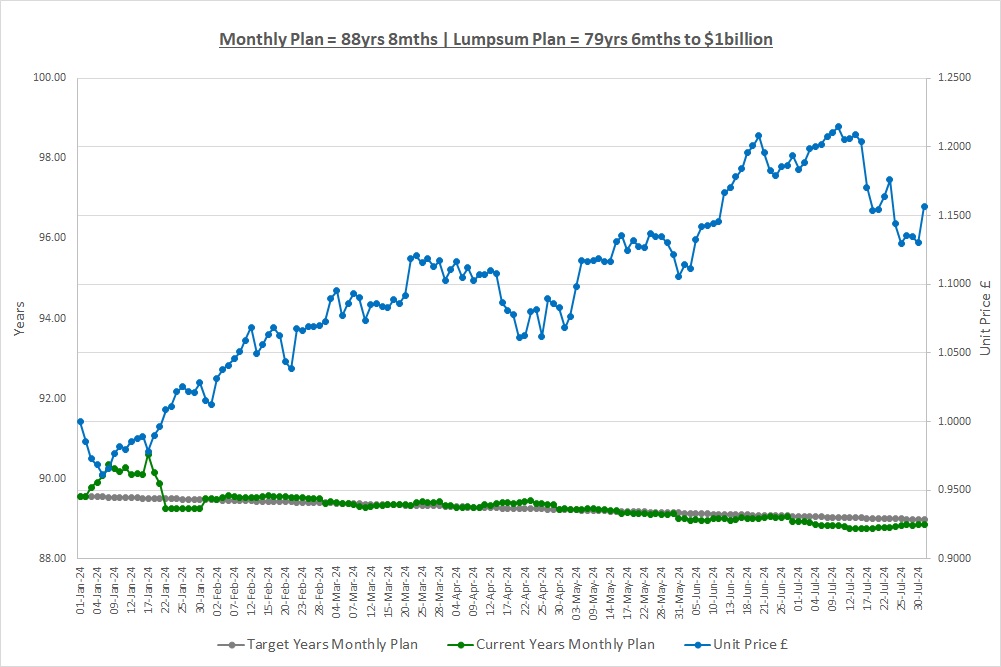

Time to $1billion: Monthly Plan 88yrs 8mths | Lumpsum Plan 79yrs 6mths

Last month we talked about stock markets which are where you can find shares in companies that have listed and stock exchanges which are where you can buy these shares. The total value of stock markets is over $100 trillion with the US being the largest at around 50% of the total. Stock markets are not complicated things requiring a PhD, they are simply places where you can buy shares in companies that make everything from toothpaste to cars. If you own shares you become a part owner of the business and so the profits the company makes belong to you.

This month we’re going to have a look at a few things companies do so we understand some of the jargon that we’ll come across as we invest. First though, we’re briefly going to talk about currencies.

CURRENCIES

Last month we mainly talked in USD when we discussed global stock markets, the month before we talked in GBP about our little coffee shop and the month before that we talked in GBP and USD when looking at inflation. So, why all these currencies?

The first reason is that the definition of a billionaire is 1 billion USD. You might be reading this in the UK saving GBP, Spain saving EUR, Japan saving JPY or China saving RMB. Unless you’re saving USD, you need to work out how much you’re worth in USD to see if you’re a billionaire and so one currency you need in addition to your own is USD. If you’re saving GBP you need to know how many USD you can buy with your GBP, if you’re saving EUR you need to know how many USD you can buy with your EUR, etc.

Another reason you need to know about currencies is that if you want to own the best companies in the world, they might not be found on your own stock market. Microsoft for example is a US company and its share price is in USD, BMW and Mercedes are both German and their share prices are in EUR and Nestle is Swiss and its share price is in CHF. If you’re saving USD and want to buy Microsoft then no problem, its share price is in USD, but if you want to buy Mercedes you need to know how many EUR you can buy with your USD.

We’ll talk more about currency in future posts but for now, just get used to seeing different currencies. Remember, currencies are really simple and the process is just the same as needing money when you go abroad on holiday. Right, on with some things that companies do.

DIVIDENDS – CASH & SCRIP

As we’ve said before, over the long run companies must make a profit otherwise they’ll go out of business. Apart from reinvesting profits in the business to grow (or buying a new corporate jet – sadly we’re not joking so watch out!), companies can also return profits to shareholders by paying something called a “Cash Dividend”. The company might say it will pay a dividend of 5p a share and you’ll receive it in cash. We’ve seen this already with The Crazy Fund receiving dividends over the last few months.

Companies might also declare something called a “Scrip Dividend” which is when shareholders can choose to get more new shares instead of cash. You might be offered 1 new share for each 20 shares you own instead of the 5p a share cash. If you own less than 20 shares you’ll get 5p a share of cash as you must own at least 20 shares for the scrip. If you own 20 or more shares you’ll get a mixture of shares and cash. For example, if you own 43 shares then 43 divided by the scrip ratio of 20 gives 2.15 scrip shares. You can’t own 0.15 of a share so you’ll get 2 scrip shares and for the 3 extra shares you own you’ll get cash of 15p (5p a share). You can then go off and sell the new shares on the stock market if you want cash.

There are 2 dates you need to know about. If you buy shares on or after the “Ex-Dividend Date” then you won’t get the dividend as the shares are “ex” (without) the dividend, you must own your shares the day before. The dividend is then paid on the “Payment Date” once the company has worked out which shareholders are entitled to the dividend. So, Dividends are really simple, they’re just a way to return profits to shareholders.

SHARE BUY BACKS

Instead of paying a cash dividend of 5p a share to all shareholders the company could take all these 5p’s and use the cash to buy back its own shares. Let’s say there are 200 million shares in issue so all the 5p’s added up total £10million. With a share buy-back, the company goes out and spends this £10million buying its own shares on the stock market. If you’re struggling to see how this benefits shareholders that’s because it’s a lot more subtle than giving them 5p a share of cash, a share buy-back’s value comes over the long-term.

Let’s use an extreme to help us understand and say you own just 1 share of the 200million, so you own 1/200millionth of the company and will be getting a life-changing 5p of cash as a dividend! Somehow (this really would be not only life-changing but a miracle!) the company does a share buy-back and manages to buy all 200million shares with the £10million apart from your 1 share. You now own the whole company as you’re the only shareholder and so next year that £10million of dividends is all yours! So, share buy-backs work by decreasing the number of shares and as a result, each share becomes more valuable as it owns more of the company than before the buy-back.

SHARE SPLITS & CONSOLIDATIONS

When a company grows its share price will go up and eventually it can reach a point where the price is so high that hardly anyone can afford to buy its shares. If you look at the share price of the company that Warren Buffett has built called Berkshire Hathaway (he’s the most successful investor of all time if you remember and is worth $120billion) you’ll see it’s $620,000 per share. That’s right, six hundred and twenty thousand dollars per share! How on earth can we invest in the company, the minimum we need is astronomical!

When a share price gets to the point that it excludes lots of investors then a company can do something called a “Share Split”. The company simply splits (divides) each existing share into a number of new ones. If Berkshire did a 100,000 for 1 share split then for each 1 share you own you’d be given 100,000 new shares and your old share would be cancelled. The share price would then adjust by the same ratio and would be 100,000 times smaller, so $6.20 per share since the value of the company cannot change. Share splits are really simple and are done to make the shares accessible to investors.

“Share Consolidations” are the opposite of splits, instead of getting more shares for each share you own you get less. If the above split had been done then a 1 for 100,000 consolidation could be done to reverse it. For each 100,000 shares you own you’d be given 1 new share and your 100,000 old shares would be cancelled, the share price would then go back up to $620,000 per share. If you only owned 500 shares to start with you can’t receive 1 new share as you need 100,000 shares before the consolidation. In this situation, you (hopefully, if it’s a good company) would be given cash and so you would end up not being a shareholder any more.

RIGHTS ISSUES

If companies needs to raise money to expand the business they have a few options. They could take out a loan from a bank or issue something called a corporate bond which is similar to a loan but with bells and whistles. The problem is that it could be expensive if the interest rate on the loan or bond is high.

Another way a company can raise money is to do a “Rights Issue” which is when they sell new shares to the existing shareholders. A company might do a 1 for 10 rights issue which means that for every 10 shares you own now you can buy 1 new share. You don’t have to buy the new shares you’re entitled to as you have the “right” to buy them but it’s your choice. If the company manages to sell all the new shares it will raise the money it needs and can go off and grow the business. Setting the price of a rights issue can be complicated and we’ll not go into it for now.

TYPES OF SHARES

So far we’ve talked about companies issuing “shares” but in the real word there are different types of shares, just to make our life complicated! The most common type are called “Ordinary” shares and with these you really are a part owner of the business. All the profits a company makes are yours but the flip side is that if the company goes bust you can lose all your money as you’ll be last in the queue to be paid if there’s anything left.

Another type of share is called a “Preference” share and these take “preference” over ordinary shares. An example might be a preference share that pays a dividend of 5% a year. This dividend will be paid before the ordinary shareholders get their dividend and if there’s no money left after paying the preference shareholders then the ordinary shareholders get nothing. The flip side is that preference shareholders will only get their 5% so if the company makes huge profits tough luck, they belong to the ordinary shareholders.

As an ordinary shareholder you are a part owner of the business but how do you let the business know what direction you would like the business to go in? The answer is that each share you own normally allows you to vote on proposals that the company makes and if lots of shareholders vote for the same thing, the directors who run the company should make it happen.

Some shares however are “non-voting” and don’t allow the shareholders to vote. This is a contentious area as it doesn’t seem right that someone can be a part owner of a company but not have a say in the direction it goes in. As a non-voting shareholder, you’ll benefit financially if the company does well but you can’t steer the company. These type of non-voting shares are often used when a founder doesn’t want to give up control and think they know best as to how to run the company.

There are a few other types of shares but we’ll not worry about those for now. By far the most common type of shares are ordinary shares but it’s good to know about the other ones.

ANNUAL REPORT & ACCOUNTS

If you’re a shareholder in a company then how do you know how the company is doing? The answer is that each year the company will produce something called an Annual Report and Accounts.

This is a document produced by the directors who run the company which tells shareholders how the business is doing and what their plan is for the business going forward. It might detail their expansion plans, cost cutting plans to improve profitability and all sorts of other strategic plans the directors have (some of which you might be able to vote on at the AGM – see later).

The Accounts go into detail about the finances of the company and there are 3 core sections: the “Profit and Loss Account” tells you whether the company has made a profit over the year; the “Balance Sheet” tells you what the Company owns at the end of the year; and the “Cash Flow Statement” shows if the business is producing cash or running out of it. We’ll talk about accounts in another post shortly (don’t get too excited!).

AUDIT

As shareholders, how do you know the accounts you’re looking at are correct? Well, before a company issues its accounts they’ll undergo something called an “Audit”. This is where an independent firm of Accountants comes in and checks that the numbers in the accounts are accurate. This gives shareholders comfort that mistakes have not been made or worse still, that the directors are not hiding anything from the shareholders.

ANNUAL GENERAL MEETING “AGM”

Each year a company will hold a meeting for shareholders called the AGM. This is where the directors will present the Annual Report and Accounts and will update shareholders on the plans for the business going forward and answer any questions shareholders may have.

A number of “Resolutions” may also be put to shareholders and the shareholders can then vote on whether or not to pass the resolutions. If a resolution is not passed then the directors of the company cannot carry out the proposed plan as the shareholders have said they don’t want it and so this is why non-voting shares are controversial.

SUMMARY

There’s a lot of jargon here and if you’re slightly confused then do some research over the next month on the areas you’re not too sure about, you’ll find they’re pretty simple once you get used to the language. All of the above actions that companies perform are to allow the business to run smoothly and grow, and to make sure the interests of the shareholders who own the business are taken into account.

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Wed 31-Jul-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 300 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | (300) | 0 |

| Total Cash £ | 50 | 0 |

| Units last month | 0 | 10,000 |

| Units bought / sold | 252 | 0 |

| Total Units owned | 252 | 10,000 |

| Unit Price £ | 1.1566 | 1.1566 |

| Fund Value £ | 291 | 11,566 |

| Total Wealth £ | 342 | 11,566 |

| FX Rate | 1.2836 | 1.2836 |

| Total Wealth $ | 439 | 14,846 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 88yrs 8mths | 79yrs 6mths |

On 01/Jul the Monthly Plan made its first investment, buying 252 units in The Crazy Fund at a unit price of 1.1895. We spent £299.76, so nearly all the £300 we saved over the first 6 months. This is a significant moment as we’re now investing and not just saving which is going to be key to becoming billionaires. We also saved another £50 into our Monthly Plan as usual. Since the Monthly Plan bought its units the unit price of the fund has gone down to 1.1566 so we’ve lost money on our investment, not the best start but we have 88 years to go so are not worried, there will be ups and downs on our journey.

THE CRAZY FUND

| Result | 28-Jun-24 | 31-Jul-24 | Move |

| Unit Price £ | 1.1934 | 1.1566 | (3.11%) |

| FX Rate | 1.2645 | 1.2836 | 1.51% |

| Unit Price $ | 1.5091 | 1.4846 | (1.60%) |

| CAGR £ | 43.16% | 28.34% | (14.82%) |

Our investments lost money this month but the FX rate moved in our favour and halved our losses. We mentioned currency at the beginning of this post, our investments are in GBP and we need to see how much we’re worth in USD and this month our GBP buy more USD. Sometimes the exchange rate moves in our favour and sometimes it goes against us and this month it’s helped us.

Below is a table of what the fund is invested in at 31/Jul:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 7.4% | 404.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 8.7% | 864.60 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.6% | 5,017.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.4% | 369.50 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 9.0% | 2,412.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 8.7% | 3,085.00 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.6% | 87.54 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.5% | 45,458.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.4% | 36,863.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 11.6% | 1,012.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.8% | ||||

| Cash | 0.2% |

Correction: LON:IITU is now shown as GBP and not USD. This was an error and we’ve updated previous posts on the website. Pricing was correctly done in GBP, it was just a fat finger in the table so apologies.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

If you look at the share prices of the investments The Crazy Fund owns you’ll see a problem for the Monthly Plan. The share price of LON:CSP1 for example is £454.58 so how on earth can we invest the £300 we saved in all 10 investments if we don’t even have enough money to buy one share in CSP1? Next month, we’ll look at how to invest small amounts of money and overcome this problem if you don’t have your own fund that makes life easy.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website https://thecrazyplan.com

© TradeFloor Promotions Limited 2024