June 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN!

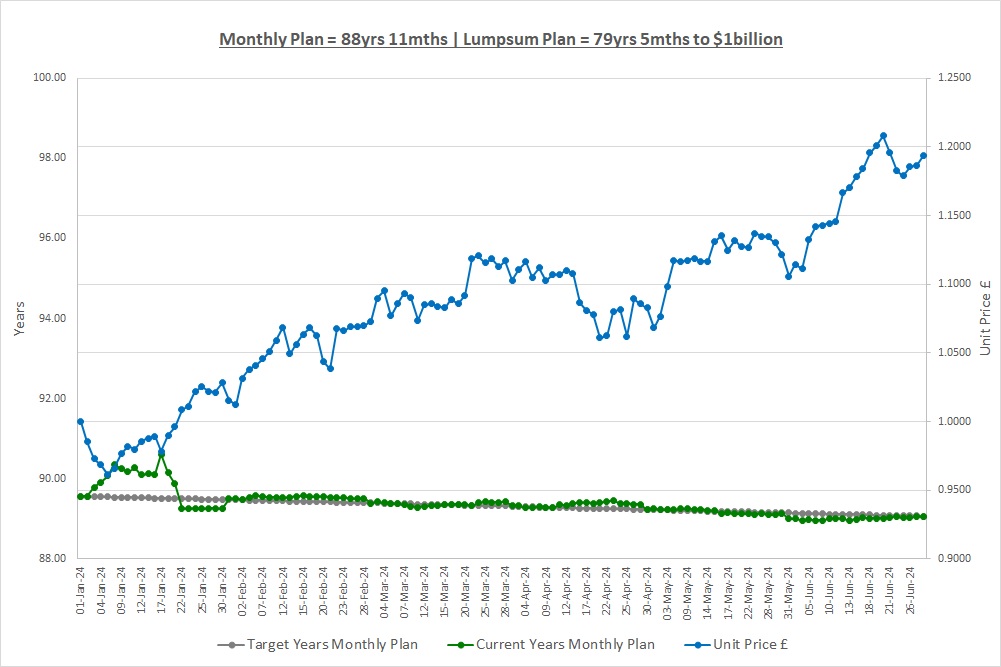

Time to $1billion: Monthly Plan 88yrs 11mths | Lumpsum Plan 79yrs 5mths

Last month we talked about companies. We looked at setting up a coffee shop and saw that as a sole trader or partnership we face unlimited liability if something goes wrong. To get around this we could set up a company, which is a legal entity that can do business, and the great thing is that a company has limited liability. We saw that companies issue shares to shareholders who literally own the company and all the profits of the company belong to them.

This month we’re going to talk about stock markets. Stock markets are the key to our plan as the S&P500 has made that magic 10% CAGR for decades which is a lot more than inflation.

PRIVATE COMPANIES

We didn’t say so last month, but the company we set up for our coffee shop is called a “Private” company. Private means the company’s shares are not available to buy anywhere, the only way you can buy them is if you know the current owners of the business who are usually the founder and their close family and friends. If you don’t know them then there’s nowhere else you can buy shares, tough luck!

Private also means that the people who own the company can choose who the investors are. Even if you know the founder and want to buy some shares they can say no, so again, tough luck! This isn’t good news for our plan as we need to be able to buy shares in companies so what do we do?

PUBLIC COMPANIES

If they want to, when a private company gets bigger, they can do something called “floating” or “listing” their shares which is also known as “going public”. When a company does this, its shares become available for any member of the public to buy and sell. The company stops being a private company and becomes a public company and when this happens, no one can stop us from buying shares. This is great news but we still have a problem, if we don’t know anyone associated with the company where do we go to buy the shares even if it’s public?

STOCK MARKETS

If you go to an antiques market we’re guessing you know what you’ll find there, antiques, duh! We’re also guessing it will be no surprise to learn that on a stock market you can find stocks (also called shares if you remember). You won’t find just any stocks though, you’ll only find shares in companies that have listed and gone public. So, stock markets are where we can find shares in public companies, it really is that simple.

The best way to think of stock markets is on a country basis. Not every country has a stock market but an awful lot do, 100 countries or so. Some countries have a small stock market and some large, it just depends on how many companies have listed there and how big those companies are. Overall, there are around 50,000 companies listed on global stock markets and the total value of them all is a little over $100 trillion. Yes that’s trillion and if you want the zeros that’s $100,000,000,000,000. Just stop and think about those numbers for a moment, stock markets truly are enormous.

The largest stock market in the world is the US stock market and it’s worth around $50 trillion, so 50% of all the stock markets in the world. Does any other country come a close second? Not a chance! Next come: China, Japan, and the UK which are around 5% each so only 1/10th of the US; and then come Australia, Canada, France, Germany and Switzerland at around 2.5% each so only 1/20th of the US. Together, these 9 countries’ stock markets make up over 80% of the world stock markets.

So, we now know where we can find companies to buy for our crazy plan, stock markets, and 50,000 companies with a value of $100 trillion is a pretty big pool to fish in!

TYPES OF COMPANIES

So, what types of companies can we find amongst the 50,000 that are listed around the world? The answer is ones that make and sell pretty much anything you can think of and then all the things you’ve never heard of! As an example, just think about brushing your teeth in the morning.

We could buy shares in: toothpaste manufacturers; chemical companies that make the ingredients for the toothpaste; mining companies that mine the commodities to sell to the chemical companies; shipping businesses that charter the ships to move the commodities from the mines to the chemical companies; transport companies that truck the toothpaste to the grocery store; truck manufacturers that make the trucks; companies that make the packaging for the toothpaste; companies that design the packaging; the grocery store that sells the toothpaste; water companies that pipe the water to your home; waste disposal companies that collect the empty toothpaste tube; advertising companies that run the marketing for the toothpaste brand; TV stations that play the adverts; and on and on and on… If you can think of it, you can buy shares in it.

This is actually a far more important point than you might think. If you speak to most people they think stock markets are high risk places only for the brave and that you need a PhD to join in. This is absolutely not true, stock markets are simply places where you can find companies that sell everyday goods and services that we buy day-in, day-out, like toothpaste. If you buy shares in these companies you own a small part of that business and the profits they make from selling for example toothpaste, belong to you.

You can buy shares in companies like Microsoft, Amazon, Meta which owns Facebook, Alphabet which owns Google, Ford, Tesla, JP Morgan, Visa, Samsung, Unilever, Netflix, Coca-Cola, Nestle, the list goes on and on and on. Is this rocket-science? No, it’s just businesses that sell social media services, cars, banking, tech, food & drink and all sorts of things that we buy day-in day-out. Never think stock markets are complicated, they are simply places you can find everyday companies to buy shares in.

STOCK EXCHANGES

Talking of buying shares in all these companies, if you want to buy shares in a company you need to find someone who is willing to sell them to you. To do this you go to somewhere called a stock exchange which is a place where buyers and sellers all come together and say what price they’re prepared to trade at. So, a stock exchange is where you can “exchange” money for shares.

In the UK the best-known stock exchange is The London Stock Exchange which was started over 200 years ago in 1801. Nowadays stock exchanges are electronic and all transactions happen digitally, people no longer meet in person like they used to. Some counties have more than one stock exchange and the best-known country for this is the US. The two big exchanges there you’ve probably heard of are the New York Stock Exchange (“NYSE”) and the Nasdaq. Each exchange might specialise in certain types of companies with the Nasdaq for example being known as the place to find technology companies.

We don’t need to worry ourselves about why there may be more than one stock exchange, as long as we can buy shares in a company that’s all that matters and exchanges are where we can do that. We’ll talk in a later post about how we actually do this.

SUMMARY

So, once a private company gets big it might choose to list its shares and go public. If it does then its shares will be part of a stock market and we, the general public, can now buy them on a stock exchange. Stock markets are not rocket-science, they’re just places where you can find great companies. If you buy shares in these companies you can benefit from being a part owner of their profits and growth which in the past has resulted in that magic 10% CAGR for the S&P500. Oh, we almost forgot, you can also find terrible companies and lose all your money but let’s not worry about that right now!

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Fri 28-Jun-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 250 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 300 | 0 |

| Units last month | 0 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 0 | 10,000 |

| Unit Price £ | 1.1934 | 1.1934 |

| Fund Value £ | 0 | 11,934 |

| Total Wealth £ | 300 | 11,934 |

| FX Rate | 1.2645 | 1.2645 |

| Total Wealth $ | 379 | 15,091 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 88yrs 11mths | 79yrs 5mths |

We’ve saved another £50 into the Monthly Plan and now have a total of £300. We’re going to invest this in the coming month as it’s now a reasonable amount. How quickly 6mths have gone, it just shows what small regular savings can do to our wealth. The Lumpsum Plan had a great month and it’s now under 80 years to reach our target. Time is our friend as compounding works its magic and slowly but surely, the years are ticking down as you can see from the green line on the next chart. Hard to believe but one day we’ll reach our target of $1billion.

THE CRAZY FUND

| Result | 31-May-24 | 28-Jun-24 | Move |

| Unit Price £ | 1.1057 | 1.1934 | 7.92% |

| FX Rate | 1.2730 | 1.2645 | (0.68%) |

| Unit Price $ | 1.4076 | 1.5091 | 7.24% |

| CAGR £ | 27.31% | 43.16% | 15.85% |

It’s been a great month with The Crazy Fund being up over 7%. As we’ve said before, we have decades to go so we’ll not get excited but this shows how being patient and waiting for the times when shares do well is key.

Below is a table of what the fund is invested in at 28/June:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 6.87% | 388.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 8.64% | 884.20 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.65% | 5,211.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.86% | 396.50 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 9.19% | 2,542.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 8.97% | 3,300.00 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.81% | 90.74 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.30% | 45,913.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.50% | 38,441.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 11.06% | 997.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.86% | ||||

| Cash | 0.14% |

Our cash balance has increased since last month as we received dividends from LON:EQQQ and LON:SMT. These dividends just slowly keep coming in as the companies we own distribute some of the profits they make to their shareholders. This is exactly what we’ve talked about this month in action, we are shareholders so we own these businesses and the profits they make are our profits.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

There are a few things that companies do that we need to be aware of. One of these is paying dividends which we’ve seen with The Crazy Fund receiving some over the last few months. We’ll cover dividends and the other main things that companies do next month and then we’ll be ready to think about how to choose which companies to invest in. Don’t forget that 2 hours of research a week, The Crazy Fund had a good month and is up almost 20% in 6 months, it seems our own research is paying off and we truly are earning $107,158 per hour.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website https://thecrazyplan.com

© TradeFloor Promotions Limited 2024