May 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN!

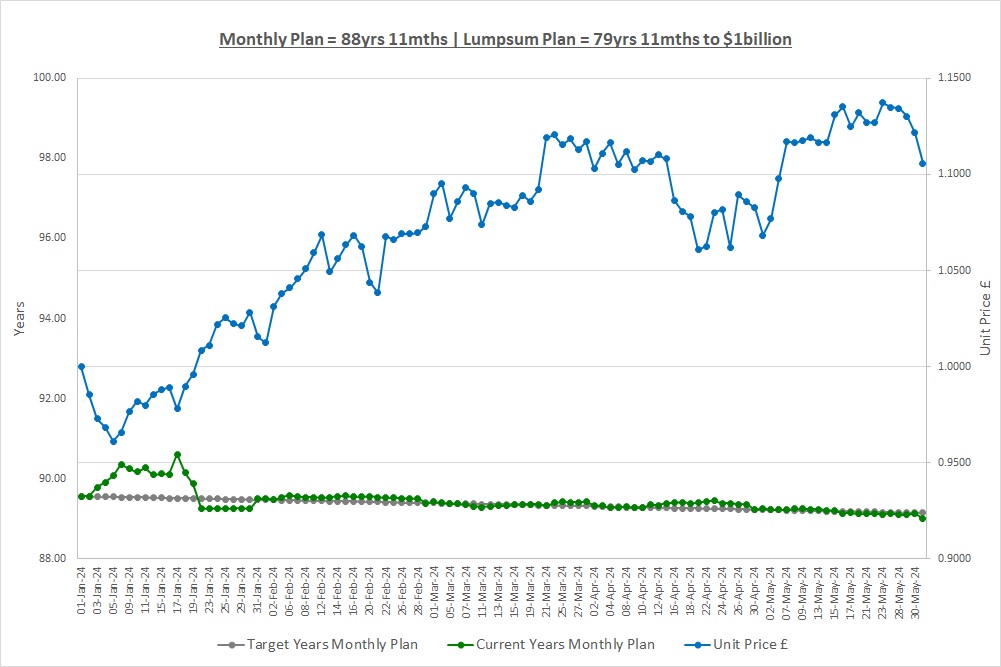

Time to $1billion: Monthly Plan 88yrs 11mths | Lumpsum Plan 79yrs 11mths

Last month we talked about Inflation, Saving and Investing and saw how compounding and inflation are a disaster for our wealth, two coffees and pastries being £687 in 100 years’ time! We said we need to save but this probably won’t be enough so we need to invest as investing has the potential to keep up with and beat inflation. We decided to invest in the Stock Markets as for us, this will be the most certain way to significantly beat inflation over the very long run.

This month we’re going to talk about what companies are as they’re the building blocks of Stock Markets. To do that, we’re going to start by talking about businesses.

BUSINESSES

We all know what businesses are, we’re surrounded by them from social media sites to hairdressers to coffee shops to on-line retailers to gyms and cinemas. The list is huge and businesses sell every possible variety of products and services you can imagine. Ultimately they must make a profit as if they don’t, or don’t at least break-even, they’ll run out of money and will eventually fail.

When we walk down the street or look online, we don’t stop and think about how all these businesses we use are set up, we just pay for our coffee and off we go. How a business is set-up is important for investing though as it determines whether or not we can invest in it. The main set-ups you’ve probably heard of are Sole Traders, Partnerships and Companies. Let’s say we want to set up a coffee shop and see how these different set-ups work.

SOLE TRADERS

Without stating the obvious, “Sole” means on your own and “Trader” means we’re trading in goods or services which in our case means coffee. Legally, Sole Trader means a little more, it means we’re running the business in our own name so we’re personally responsible for everything in the business. If a supplier needs paying then we need to pay them and likewise, all the money we get from selling coffee belongs to us.

At the end of the year, we work out our Sales and Costs and tell the tax man our profit. We’ll pay income tax on our profits just as employees pay income tax on their salaries. This sounds great, we only pay tax on profits, but what if we want to go into business with a friend? Well for that we could set up a Partnership.

PARTNERSHIPS

A Partnership is when two or more people set up a business together and have a Partnership Agreement that says how they’ll run the business and share the profits. Just like a Sole Trader, the business will legally be run in their own names and so they’ll each be personally responsible for the business.

Let’s say we have a friend who has some money to put in to our coffee shop to get us up and running. We could set up a 60:40 Partnership where they are a “Silent Partner.” They own 40% of the business but as they’re a Silent Partner, they don’t do any work. At the end of the year, we put 60% of the profits on our tax return and they put the other 40% on theirs and we each pay income tax. We can think of this as having sold them 40% of the business for the money they put in.

A Partnership then, is like two Sole Traders working together, everything is legally in our own names and it’s pretty simple to set up and get going, but there can be problems.

SOLE TRADER AND PARTNERSHIP PROBLEMS

A major problem for Sole Traders and Partnerships is liability. Let’s say someone walks into our coffee shop, slips on a croissant, bangs their head and dies from a brain haemorrhage. Oh, and one important thing, there’s only £100 in the till. The family of the croissant-slipping customer sues us and wins £1million in damages so we give them the £100 from the till and say “really sorry, that’s it.” The problem is, as we’re a Sole Trader or a Partnership they’re suing us personally as the business is legally in our name. We still owe them £999,900 and this means we’ll have to sell our house, TV, car, shirt, everything we own until we’ve paid them. This is because we have unlimited liability and we think you’ll agree, this is a pretty big drawback to running a business as a Sole Trader or Partnership.

Another problem with being a Sole Trader or Partnership is if we want to raise money to grow the business. We would have to agree new Partnerships with new investors and amend all the existing Partnerships to reflect the new ownership. This all assumes our new investors are happy with this unlimited liability to croissant-slipping customers, which we very much doubt.

There are lots of other limitations with setting up as a Sole Trader or a Partnership and so what can we do? One solution, which is extremely common, is to set up something called a “Company.”

COMPANIES

As individuals we physically exist and have legal rights. If we set up as a Sole Trader or Partnership we use these legal rights to run our business, so we’re allowed to take money from people in exchange for a coffee and we can have a bank account.

Legally we can also set up something called a “Company” to run a business. A company does not physically exist, it’s just a legal creation on paper (or “Legal Entity”) and there are laws saying what companies can do in the same way there are laws for us as individuals. Setting up a company is called “incorporating” a company and is fairly easy to do, just some paperwork to file and a small fee.

Let’s now say we set up a company to start our coffee business. The way a company is owned is through the company issuing something called “shares.” So, our company issues 100 shares and we own 60 of them and our friend owns 40, giving the 60:40 ownership we want.

We run the business the same way as when we were a Partnership but now the company has a bank account and when a supplier needs paying, it’s the company that’s liable not us personally. If staff are needed it’s the company that employs them, not us. Everything is done in the name of the company.

At the end of the year, we work out the Sales and Costs again to give the profit. Now though, it’s the company’s profit and the company pays something called Corporation Tax on it and we don’t put anything on our personal tax return. If we want to get the £100 in the till out of the company, the company can pay something called a “Dividend” and we’ve seen dividends come in to the Crazy Fund over the last few months. This dividend works out to be £1 per share (£100 dividend / 100 shares in issue) so we’ll get £60 as we own 60 shares and our friend will get £40. We’ll probably have to put these amounts on our personal tax returns and pay income tax on them.

ADVANTAGES OF A COMPANY

So, what are the main advantages of a company? Well, you can probably guess that a company can overcome the two problems we had above as well as many others.

The family of our croissant-slipping customer will now have to sue the company as it’s the company that runs the business. The company has limited liability which means once the company is out of money that’s it and importantly, the shareholders are not liable. They can force the business to close and sell off all the cakes and coffee and take that money, but shareholders don’t have to make up the shortfall. We think you’ll agree, this is a huge advantage to running a business as a company.

Another advantage of a company is that it makes it easier to raise money to grow. If we have 10 friends who each put £5,000 in to the company they could each receive 1 share in exchange. Overall, the company will raise £50,000 and can go off and open a new coffee shop. The company now has 12 shareholders and 110 shares in issue (100 original shares + 10 newly issued shares). This is far easier than re-doing all the Partnerships needed and more importantly, shareholders love this set-up as they have no liability to our croissant-slipping customer.

SHARES, STOCK & STOCKS

So, a company issues “shares” to “shareholders” and the shareholders own the company. This is really important, if you own shares in a company you actually own part of the company and if the company makes a profit, part of it belongs to you.

You’ll also hear the word “stock” used and you could say that all the shares a company has issued are its stock. So, for our coffee company the total stock is 110 shares. It’s not too big a leap to guess what Stock Markets are, they’re places where you can buy and sell a company’s stock and you do this by buying its shares. This means a share is the smallest unit of stock.

In reality, the difference between shares and stock is blurred and mixed up all the time. Some people say they bought shares in a company and others say they bought stock, some say they’re a shareholder and others say they’re a stockholder, some say they own shares and others say they own stocks. For our purposes it’s all one and the same so don’t worry too much, it’s just that foreign language thing again!

SUMMARY

At the end of the day, Companies are very simple, they’re just a legal set-up that allows people to carry out a business rather than doing it in their own name. Whether it’s selling coffee, phones, social media services, boats, food or anything you can think of, a business can be set up and run as a company.

The Company set-up has advantages including limited liability and making it easy to manage lots of investors. A company issues shares to shareholders (or stock to stockholders) who own the company and therefore the profits of the company belong to them which sounds good, someone else does the work and we get the profits!

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Fri 31-May-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 200 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 250 | 0 |

| Units last month | 0 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 0 | 10,000 |

| Unit Price £ | 1.1057 | 1.1057 |

| Fund Value £ | 0 | 11,057 |

| Total Wealth £ | 250 | 11,057 |

| FX Rate | 1.2730 | 1.2730 |

| Total Wealth $ | 318 | 14,076 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 88yrs 11mths | 79yrs 11mths |

Although compared to the Lumpsum plan £50 a month is not very much, our wealth on the Monthly Plan is slowly building and we’re on track. Remember, it’s only going to take around 9 years longer than the Lumpsum Plan to hit that $1billion we’re aiming for.

THE CRAZY FUND

| Result | 30-Apr-24 | 31-May-24 | Move |

| Unit Price £ | 1.0827 | 1.1057 | 2.13% |

| FX Rate | 1.2559 | 1.2730 | 1.37% |

| Unit Price $ | 1.3598 | 1.4076 | 3.50% |

| CAGR £ | 27.11% | 27.31% | 0.20% |

It was a better month after our first loss last month. Our investments went up in value and the £ to $ exchange rate to see how much we’re worth in $ went our way too. We can see from the chart how noisy, or volatile, investing is and we need to just ride out these ups and downs and think long-term.

Below is a table of what the fund is invested in at 31/May:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 7.61% | 398.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 9.26% | 878.00 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.84% | 4,910.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.22% | 346.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 8.76% | 2,244.50 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 8.77% | 2,990.00 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.36% | 81.43 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.45% | 43,147.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.34% | 35,121.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 11.27% | 941.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.88% | ||||

| Cash | 0.12% |

We made no investments or divestments in the month and no dividends were received.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month we’re going to talk about Stock Markets and how a company can get on a Stock Market. If a company is on a Stock Market it means we can buy its shares and that’s a good thing. If you remember, the S&P500 is the biggest 500 companies in the US and has made a 10% CAGR for over 50 years, being able to invest in companies is key to our plan.

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website https://thecrazyplan.com

© TradeFloor Promotions Limited 2024