April 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN!

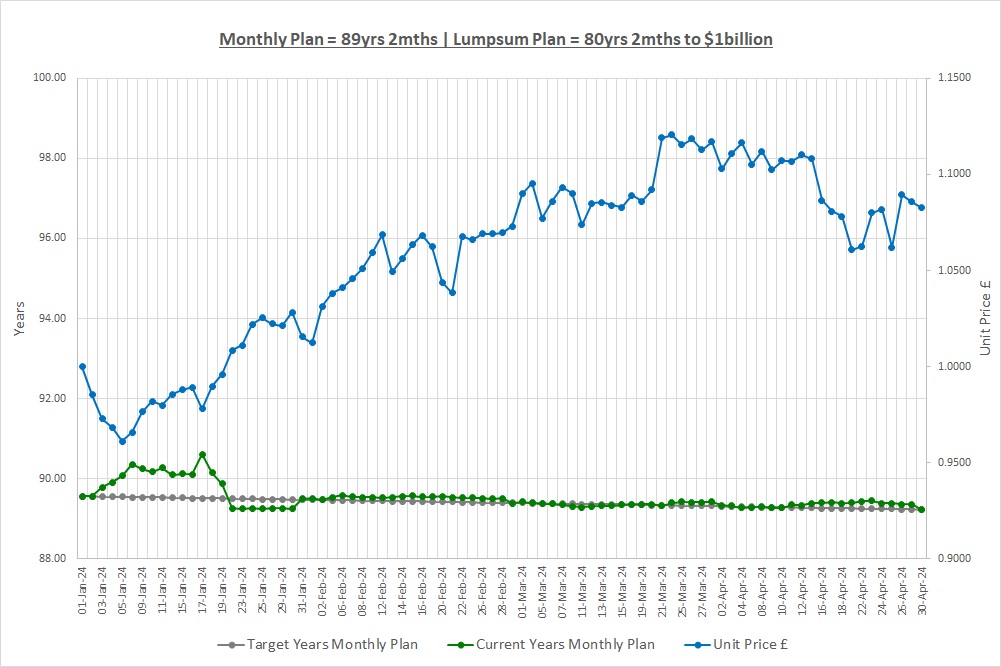

Time to $1billion: Monthly Plan 89yrs 2mths | Lumpsum Plan 80yrs 2mths

Last month we looked at CAGR and showed why this might not be such a crazy plan after all. We saw that CAGR tells us how much something grows by year in year out when we don’t take any money out and that over long periods of time, the power of compounding is staggering. Warren Buffett has achieved a 20% CAGR and if we start with £10,000 and do that we’ll be worth $44.7trillion in 120years time! We also looked at another crazy plan and saw how Richard Williams defied the odds and created tennis superstars. Having a plan and executing it can produce extraordinary results so don’t laugh at us just yet!

This month we’re going to talk about what investing is and what it needs to achieve so to do that, we’re going to have to look at inflation first.

INFLATION

Life is almost completely dependent on money, gone are the days where we can head to the café and offer to cut the manager’s grass in return for our coffee and cake! All money really is, is a measure of how much stuff we can buy, the more money we have the more stuff we can buy, it’s that simple. If we can buy more stuff then we can have a better life. Our plan, to make our family $1billion, is simply so we can buy more stuff and have a great life and money is what will allow us to do this.

The problem is we’re always chasing our tail due to inflation constantly making the stuff we want to buy more expensive. We’re all too aware of it at the moment as we’re coming to the end of a period where prices have been rising 10% a year and we have to go back to the 1970’s for the last time that happened in western economies. Four or five years ago, when inflation was around 2-4%, our coffee might go up by 5p but we didn’t really notice. So, the problem is that over time inflation means we can buy less and less stuff but is it such a big deal if it’s normally only 5p on a coffee? To find out we’ve had a look at the Bank of England website and their inflation calculator and have produced the following table:

| Time (Yrs) | Year | Inflation | Index |

| 100 | 1924 | 4.00% | 50.62 |

| 75 | 1949 | 4.61% | 29.42 |

| 50 | 1974 | 4.52% | 9.13 |

| 25 | 1999 | 2.47% | 1.84 |

If we look at the third column, over the last 100 years inflation has been 4% pa (that’s a CAGR) and we expect you’re saying, “Phew, the last couple of years are just a blip.” We can also see in the table that inflation has been pretty constant, it doesn’t matter if we look over the last 50, 75 or 100 years, it’s been 4% or more. Sure, it’s been a little lower over the last 25 years, but we’re investing for future generations and so 25 years is a short time.

The problem with inflation, even though it’s normally been quite small, is that wonderful thing called compounding. You see, unfortunately, compounding is not so wonderful when it comes to inflation, in fact it becomes a nightmare. We can see this in the last column, “Index”, where we see something that cost £1 one hundred years ago now costs £50.62.

We went out for a couple of coffees and two croissants the other day and the bill came to £13.60. In 100years time the bill will be a staggering £687! Don’t believe us? Go and find the oldest person you know and ask them what things cost when they were young. Inflation is usually hidden and out of site, 5p on a cup of coffee, 2p on a can of coke, but the problem is that over long periods of time it compounds and completely destroys our wealth. We’ve also looked at inflation in the US and it’s pretty similar, maybe 0.50% lower at 3.50%, but it’s there, everywhere, killing our wealth.

So, whatever plan we have must ensure we earn more than inflation over the long run. If we don’t, we’ll slowly get poorer and that means we won’t be able to buy all that stuff to give us a great life. This is where investing comes in, but before we can invest we need some money! To get that money we need to start saving.

SAVING

We’re going to state the obvious but saving is putting cash aside for the future, normally in a bank account where it’s safe, and we usually earn interest on our savings. There are a couple of methods of saving and they result in very different results. The first is we: get paid; pay our bills such as rent or mortgage and utilities; go out and buy lots of stuff like takeaways, dinners, drinks, snazzy phones, clothes, etc; and then we save what’s left. This usually results in saving a grand total of zero or worse, going into debt. The second method is we: get paid; pay our bills; put £50 a month into our crazy plan; and then go out and do and buy all that other stuff but do not go into debt.

It’s not too hard to work out which plan we need to be on, the second, but this is only the start. Saving is great and necessary but unfortunately, on its own it won’t overcome the wealth destroying impact of inflation. Even if we save our money and earn some interest in the bank, over the very long term we’ll be lucky to keep up with inflation. The interest rate we receive over the long run will probably be less than the 4% inflation we expect to see so we’ll slowly get poorer despite being responsible savers.

So, what can we do? Well, firstly we must save as this is how we’ll build up the capital (a fancy word for money) that we can then invest. Once we’ve saved some capital we need to find something to invest in.

INVESTING

Investing is taking money that we’ve saved and using it to buy something that we believe will go up in value by more than inflation. This “more than inflation” bit is key as we’ve just seen with the £687 coffee bill. So, what can we invest in? Well, we can invest in assets (a fancy word for types of things that have value) and there are hundreds of assets we could invest in including stocks, bonds, property, wine, cars, art, gold and all sorts of others.

We now know that the key to choosing which asset to invest in is the 4% inflation hurdle we need to beat. Assets we invest in must have a balance of two things. Firstly, the asset’s CAGR must be significantly above our 4% inflation hurdle. Secondly, the asset must give us a really high probability of achieving that CAGR. Both of these things, the return and the certainty of return, must be assessed over long periods of time.

In terms of how to measure “a really high probability”, we want something that’s historically made money decade in, decade out. In the past, if an asset made a 50% CAGR for 10 years and then did nothing for 30 years then that’s no use. It would be a lottery ticket investment as we might be there in 20years time having made nothing again even though we “hoped” the good old times would have returned. “Hope” is not a strategy so when we’re trying to find assets to invest in we need to see consistent returns in the past over a long period of time. No one has a crystal ball and so all we can do is try and find assets that have consistently done well in the past over long periods of time.

If we look at the returns of all the assets mentioned above from stocks to art over the last 50+ years, the one we believe is most likely to consistently beat inflation by a wide margin is stocks. We said last month that the biggest stock market in the world, the US market, has returned around 10% CAGR over the last 50+ years. This is way ahead of the 4% inflation we need to beat and it’s also been consistent which is key. There will of course be periods where other assets do better than stocks for a while but over the long run, stocks have historically come out on top.

Another factor that’s important is that stocks are accessible with very small amounts of money and we’re only saving £50 a month on the Monthly Plan. If we want to invest in cars then a Ferrari 250 GTO sold for just over $50million so we’re not quite there yet! We’re not saying these other assets aren’t good investments, if you have experience in a particular asset you could be better off investing in it rather than stocks but for us, stocks are the way forward.

If you’re sitting there wondering what a stock is then don’t worry, next month we’ll cover that, just understand that for 50+ years something called stocks have been one of the best assets to invest in for the return they give (10% CAGR) and the consistency of that return.

BRINGING IT ALL TOGETHER

So, our definition of investing is using money we’ve saved to buy an asset that we believe will increase in value by more than inflation over the long run. If we don’t achieve a return of more than inflation we’ll become poorer and won’t be able to buy the stuff we want. Let’s just have a look at the 3 stages of investing from inflation (stuffing our money under the mattress) to saving (being responsible) to investing (having a plan to make $1billion):

| Coffee Round | Rate | Start £ | 100 Years £ | Trips |

| Inflation | 4.0% | 13.60 | 687 | 0 |

| Saving | 3.0% | 13.60 | 261 | 0.38 |

| Investing | 10.0% | 13.60 | 187,416 | 272 |

The table shows that if we do nothing and put our £13.60 under the mattress, our family won’t be going out for coffee in 100years time as £13.60 won’t even come close to the £687 bill!

If we save our £13.60 in the bank and earn an interest rate of 3% a year (a complete guess) over the next 100 years then they’ll find they only have £261 in the bank when the coffee round is £687. They won’t even have half what they need despite only earning 1% less than inflation.

Now, if we invest our £13.60 in the US stock market and it returns a 10% CAGR they’ll end up with £187,416 in 100years time. This means they’ll be able to go to the coffee shop 272 times and we like the sound of that! If it sounds a little crazy that £13.60 becomes £187,416 over 100 years, do you want to know what it becomes if we earn a CAGR of 15%? £16million, that’s not a typo and yes, you’ve read that correctly.

We hate to bang our own drum but this also shows how we really need to resist that whole temptation thing we were going on about the other month. Of course, future returns may not look like the past, we might not earn 10%, we might earn more or less, but of all the assets we’ve looked at we believe investing in stocks will give us the greatest possibility of beating inflation and reaching $1billion.

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Tue 30-Apr-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 150 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 200 | 0 |

| Units last month | 0 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 0 | 10,000 |

| Unit Price £ | 1.0827 | 1.0827 |

| Fund Value £ | 0 | 10,827 |

| Total Wealth £ | 200 | 10,827 |

| FX Rate | 1.2559 | 1.2559 |

| Total Wealth $ | 251 | 13,598 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 89yrs 2mths | 80yrs 2mths |

Another £50 into the Monthly Plan, we’re well on our way now and are in a great habit of saving, the investing part will come soon. The Lumpsum Plan had a bad month, losing over 3%. Last month we said we couldn’t get excited about having made a lot of money over the first 3 months and this is why, investing is noisy, so we’re not going to get upset about losing money either.

THE CRAZY FUND

| Result | 28-Mar-24 | 30-Apr-24 | Move |

| Unit Price £ | 1.1169 | 1.0827 | (3.06%) |

| FX Rate | 1.2616 | 1.2559 | (0.45%) |

| Unit Price $ | 1.4091 | 1.3598 | (3.51%) |

| CAGR £ | 58.23% | 27.11% | (31.12%) |

The fund lost 3.51% in USD over the month, our investments lost 3% and the FX rate £ to $ also went against us by 0.50%. The chart shows that at one point we’d lost even more than this, we were down over 5%. Our CAGR has collapsed because we’re only 4 months in so a monthly loss of 3% has a huge impact as it represents ¼ of the time we’ve been investing for. This is why we’re capping our target return at 15% and not using the historic CAGR we’re actually achieving as it moves about too much whilst we get some months behind us. We’ll still take a CAGR of 27.11% though but sadly, we know that over time this will come down.

Below is a table of what the fund is invested in at 30/April:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 7.49% | 384.00 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 9.08% | 842.60 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.82% | 4,799.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.44% | 346.00 | GBP | IT | Allianz Technology Trust PLC |

| LON:IITU | 8.52% | 2,138.00 | GBP | ETF | iShares S&P 500 Information Technology |

| LON:PCT | 8.75% | 2,920.00 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.12% | 77.01 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:CSP1 | 10.57% | 42,730.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.36% | 34,452.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 11.73% | 959.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.88% | ||||

| Cash | 0.12% |

On 24th April we sold our shares in LON:MTE (Montanaro European Smaller Companies Trust PLC) and bought shares in LON:IITU (iShares S&P 500 Information Technology). We’ve been doing our research and think this new holding in IITU will suit our portfolio better.

Our cash holding has also changed and there are two reasons for this. Firstly, LON:JAM declared a dividend and so our cash holding went up. These dividends will slowly come in and we’ll use them to buy more shares when our total cash balance gets larger. Secondly, the amount we spent on buying IITU was slightly different to the amount we received from selling MTE and so this changed our cash balance.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

We keep talking about investing in stocks and stock markets but we haven’t actually talked about what a stock is. Next month we’ll go over the basics of what stocks are and we’ll show that they’re not complicated at all, in fact they’re pretty simple to understand. Don’t forget to do a couple of hours research each week as that’s we found IITU to replace MTE in our portfolio. Remember, we’re earning $107,158 an hour when we do research!

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website https://thecrazyplan.com

© TradeFloor Promotions Limited 2024