March 2024

WELCOME

Welcome to The Crazy Plan where our mission is to show that anyone can create unimaginable wealth.

Each month, we publish a blog providing readers with the financial education needed to set out on their own journey to a bright financial future. We do this by following two plans, our Monthly Plan saves £50 a month for 10 years and our Lumpsum Plan starts with a one-off £10,000. Our aim is to turn each plan into $1 billion in one or two generations.

At first, making $1 billion seems crazy but once you realise it’s a journey then things change. We’ll save our first £50 and from there our wealth will build to $1,000, then $5,000, then $10,000 and then $50,000. One day, if we’re patient, we’ll have $100,000 and then we’ll be looking at $1 million. From there it will be onwards to our $1 billion goal. This journey of small steps is how what seems impossible becomes possible.

You can dig-in to our posts however you like or if you are completely new to investing, you may want to start with “1.0 Liftoff!” and go through them in order which is how we build the education. We hope to provide you with the knowledge needed to set out on your own journey to a bright financial future if you choose. You can also visit the “About” page on our website to learn more about our plan.

All readers must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website: https://thecrazyplan.com

ON WITH THE PLAN!

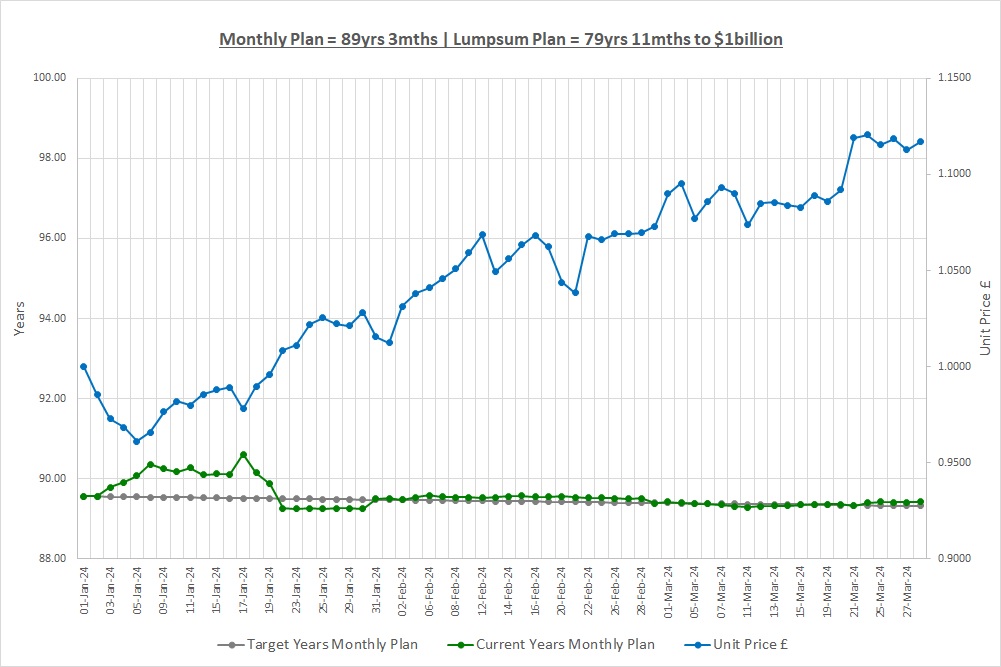

Time to $1billion: Monthly Plan 89yrs 3mths | Lumpsum Plan 79yrs 11mths

Last month we said three of the main contributors to whether or not we’ll be successful in becoming billionaires have nothing to do with how to pick what to invest in. They are our ability to commit to our plan, whether we’re prepared to sacrifice the time needed and whether we can resist the temptation to spend.

As most people think we’re crazy when we tell them our plan, this month we’re going to show how we expect our plan to unfold and why perhaps we’re not so crazy after all. First though, we need to understand something called CAGR.

CAGR

CAGR stands for Compound Annual Growth Rate so let’s look at the 3 parts: Growth Rate; Annual; and Compound.

“Growth Rate” is simply how much something increases or decreases by. If we start with £10,000 and the growth rate is 15% then we make £1,500 (£10,000 * 15%) and we end up with £11,500. If the growth rate is (15%) so negative, then we lose £1,500 and end up with £8,500.

“Annual” refers to the period that the Growth Rate is for. So, in the above examples, our £10,000 will have grown to £11,500 or reduced to £8,500 after 1 year. The rate could be quoted as Annual, Semi-Annual, Quarterly or any other time period.

“Compound“ means you get the growth again and again, but very importantly, it means you don’t take any money out so you get growth on the growth. Let’s say we can invest at a 2yr CAGR of +15% which means we can invest our money for a total of 2years and it will grow at an Annual Growth Rate of +15%. Because it’s Compound, we don’t take any money out over the 2year period.

At the end of the first year, we’ll have £11,500 as per above. In the second year we’ll now earn more as we start with £11,500 so we earn £1,725 (£11,500 * 15%) and we’ll end the second year with £13,225 (£10,000 + £1,500 + £1,725). If we didn’t Compound, in the second year we would start with £10,000 again and earn £1,500 finishing with £13,000 (£10,000 + £1,500 + £1,500).

This extra £225 may not seem like much but as we’ll see later on, over a long period of time it’s more powerful than you can ever imagine and is the secret to becoming extremely wealthy. So, Compound means you earn growth on growth, i.e. you resist the temptation to spend. We cannot emphasise enough how important this is, don’t spend!

BEWARE THE AVERAGE TRAP

A quick diversion here as we need to be aware of the average trap. Let’s say we have £10,000 to invest and have two options and both are for 2 years: Investment #1 has an Average return of 20%; and Investment #2 has a CAGR of 15% Which investment will you take?

Are you tempted by Investment #1? After all, 20% is bigger than 15% right? The thing is, you can’t make a decision unless you know what the returns are for each year for Investment #1.

Investment #2 is easy now we know all about CAGR and we’ll have £13,225 at the end of the second year as we have just discussed above.

For Investment #1, let’s say the growth rates are (60%) for year 1 (a whopping loss) and 100% for year 2 (a whopping gain). At the end of year 1 our £10,000 is only worth £4,000, we lost 60% of our money. In year 2 we made 100% but we only started with £4,000 so we end year 2 with £8,000. Overall, we have lost £2,000 despite the average return being +20% (Average = ((60%) + 100%) / 2).

So, an average return is completely and utterly useless as we can’t tell if we make or lose money! We’ll say that again, an average return is completely and utterly useless. Unfortunately, when we do our research, we might see people quoting average returns including people who should know better. If ever we see an average return it means nothing until we carefully study the underlying annual returns and we should always ask for the CAGR. Never, ever, fall into the average trap, always use CAGR.

A NOT-SO-CRAZY TENNIS PLAN

Before we show you why our plan might not be quite so crazy, we want to have a quick look at another crazy plan in the world of tennis. We watched a great film the other day called King Richard which is about Richard Williams and his daughters, Venus and Serena, of tennis fame. They are undisputedly two of the greatest tennis players of all time, but what’s so incredible is not their talent but that their whole success was completely planned by their father. After seeing a female tennis player win a staggering amount of prize money he decided he was going to change his family’s future and turn his daughters into tennis stars.

He wrote out a 78page plan on how to accomplish this and then set out to do it. What is remarkable is that he was not from the tennis world and did not (apparently) have the money to do it. Despite these two rather large obstacles, he believed in his plan, himself and his family and set about making it happen. He was laughed at more times that you can imagine when he told people his 5year old daughters were going to win Wimbledon!

As a family, day in day out, year after year they focused on tennis, executing the plan and revising it when needed. Like our post talks about last month, they practiced and practiced and practiced. There was no talent in the early years, just shear hard work on the tennis court and research by their father. Slowly, after many years, people started to say that Venus and Serena were talented but guess what? They kept practicing despite the supposed “talent” that had been discovered. The rest is history.

Just like Richard Williams was laughed at in those early years, our plan is laughable to some people. However, just like him, we believe in our plan and are committed to making it happen. We know it is achievable, we have a plan and we’re going to make it happen. Now that we know all about CAGR, we can take a look at why our plan might not be so crazy and why we’re not taking up tennis just yet!

THE CRAZY PLAN

So, turn £50 a month over 10 years or a Lumpsum of £10,000 into $1billion in 80-120 years? This is our plan as we said right at the start in our first post “1.0 Liftoff!” Take a look at the next table:

| CAGR | 10.00% | 10.00% | 15.00% | 15.00% | 20.00% | 20.00% |

| Years | Monthly | Lumpsum | Monthly | Lumpsum | Monthly | Lumpsum |

| 0 | $189 | $14,091 | $189 | $14,091 | $189 | $14,091 |

| 5 | $4,926 | $22,693 | $5,484 | $28,342 | $6,104 | $35,062 |

| 10 | $12,366 | $36,548 | $15,945 | $57,005 | $20,632 | $87,247 |

| 20 | $32,073 | $94,796 | $64,508 | $230,618 | $127,749 | $540,208 |

| 30 | $83,190 | $245,876 | $260,972 | $932,978 | $790,988 | $3.3m |

| 40 | $215,772 | $637,740 | $1.1m | $3.8m | $4.9m | $20.7m |

| 50 | $559,658 | $1.7m | $4.3m | $15.3m | $30.3m | $128.2m |

| 60 | $1.5m | $4.3m | $17.3m | $61.8m | $187.8m | $794.0m |

| 70 | $3.8m | $11.1m | $69.9m | $249.9m | $1.2bn | $4.9bn |

| 80 | $9.8m | $28.9m | $282.8m | $1.0bn | $7.2bn | $30.4bn |

| 90 | $25.3m | $74.9m | $1.1bn | $4.1bn | $44.6bn | $188.5bn |

| 100 | $65.7m | $194.2m | $4.6bn | $16.5bn | $276.0bn | $1.2tn |

| 110 | $170.4m | $503.7m | $18.7bn | $66.9bn | $1.7tn | $7.2tn |

| 120 | $442.0m | $1.3bn | $75.8bn | $270.8bn | $10.6tn | $44.7tn |

The table shows what happens if we resist the temptation to spend and let the extraordinary power of compounding over long periods of time work its magic. There are projections for CAGRs of 10%, 15% and 20% for each of the Monthly and Lumpsum plans. The early years make it look impossible to make $1billion but it’s these early years that set us up for the big years later down the line, it’s that simple.

If you look at the 100year line for Lumpsum at 15% in the table, you’ll see that we estimate we’ll have $16.5billion after 100 years, yes that really is $16.5billion. If we didn’t compound but took our returns out each year and put them under the mattress, we would have $201,856. This is calculated as £1,500 a year for 100 years, so £150,000, which added to our initial £10,000 is £160,000. At an FX rate of £1 = $1.2616 this is $201,856.

That’s right, if we let compounding do its thing we’ll have $16.5billion but if we don’t, we’ll only have $201,856! To say the impact of Compounding over long periods of time is staggering is a huge understatement, in fact we’re not sure there is a word for it.

On the Monthly Plan with 15% CAGR after 10 years we can see we’re worth $15,945. Over the 10years from year 80 to 90 however, we make over $800million! This is not fantasy, like we said last month, the great Mr Warren Buffett is worth around $120billion and if he makes 10% this year he’ll make $12billion in a year! It’s hard to believe but it’s true and so we must start.

Take a look at what happens if we earn 20% CAGR, now that really is crazy and we’re sure our family will be rather happy! If we make 10% a year our family still have a rather nice future to look forward to.

We make all our money after many hard, long years of people laughing at us and this is rather like Venus and Serena, they won their tournaments after many, many, long hard years of practice and people laughing at them and their father.

The main question of course is what CAGR to use? A lot of people reading this will say we’re too optimistic to use 15% but we’ll see. The biggest stock market in the world, the US market, has returned around 10% CAGR over the last 50 years and Mr Buffett has made around 20% CAGR. We’ve been investing since 2010 and feel that in the middle, around 15% CAGR, is reasonable but there’s nothing to say that returns going forward will be the same, they could be more or less, no one knows.

We’ll look at long run returns in another post but for now we’ll lick our lips as we look at that number in the bottom right-hand corner of the table, is that really $44.7 trillion? Even we think that’s a little crazy!

THE INVESTMENT REPORT

For an explanation of The Investment Report and The Crazy Fund please see our post “1.1 The Deep End”

| Thu 28-Mar-24 | Monthly Plan | Lumpsum Plan |

| Cash last month £ | 100 | 0 |

| Cash Saved £ | 50 | 0 |

| Unit buys / sells £ | 0 | 0 |

| Total Cash £ | 150 | 0 |

| Units last month | 0 | 10,000 |

| Units bought / sold | 0 | 0 |

| Total Units owned | 0 | 10,000 |

| Unit Price £ | 1.1169 | 1.1169 |

| Fund Value £ | 0 | 11,169 |

| Total Wealth £ | 150 | 11,169 |

| FX Rate | 1.2616 | 1.2616 |

| Total Wealth $ | 189 | 14,091 |

| Estimated CAGR | 15.00% | 15.00% |

| Years to $1billion | 89yrs 3mths | 79yrs 11mths |

We saved another £50 into the Monthly Plan and now have £150, what a change from the beginning of the year when we had no savings at all. The Lumpsum Plan had another great month and is now up 11.69% since inception. Have we been lucky over the last 3 months? We have made returns larger than we expect over the long run but there will be periods like this when we do extremely well, followed by periods where we lose a lot of money. We simply cannot get excited about what has happened over 3 months.

THE CRAZY FUND

| Result | 29-Feb-24 | 28-Mar-24 | Move |

| Unit Price £ | 1.0731 | 1.1169 | 4.08% |

| FX Rate | 1.2663 | 1.2616 | (0.38%) |

| Unit Price $ | 1.3589 | 1.4091 | 3.70% |

| CAGR £ | 53.65% | 58.23% | 4.58% |

We’ve added CAGR to the table this month. In 3months we’ve made 11.69% so this is a Compound “Quarterly” Growth Rate of 11.69%. If we keep compounding at this rate every 3months (we won’t!) then after a year we’ll be up 58.23%. We’ve stuck with our assumption of 15% CAGR for our long run return as 58.23% really is crazy!

Below is a table of what the fund is invested in at 28/March:

| Ticker | % Fund | Price | CCY | Type | Description |

| LON:IEM | 7.61% | 402.50 | GBP | IT | Impax Environmental Markets PLC |

| LON:SMT | 9.34% | 894.00 | GBP | IT | Scottish Mortgage Investment Trust PLC |

| LON:XDEM | 10.77% | 4,928.00 | GBP | ETF | DB X-Trackers MSCI World Momentum Factor UCITS |

| LON:ATT | 10.17% | 347.50 | GBP | IT | Allianz Technology Trust PLC |

| LON:PCT | 8.71% | 3,000.00 | GBP | IT | Polar Capital Technology Trust PLC |

| LON:XDWT | 11.23% | 80.58 | USD | ETF | Xtrackers MSCI World Information Technology UCITS |

| LON:MTE | 8.64% | 142.50 | GBP | IT | Montanaro European Smaller Companies Trust PLC |

| LON:CSP1 | 10.48% | 43,706.00 | GBP | ETF | iShares Core S&P 500 UCITS (Acc) GBP Hedged |

| LON:EQQQ | 11.29% | 35,311.00 | GBP | ETF | Invesco NASDAQ 100 UCITS GBP Hedged |

| LON:JAM | 11.69% | 986.00 | GBP | IT | JP Morgan American Investment Trust PLC |

| Shares | 99.93% | ||||

| Cash | 0.07% |

We made no investments or divestments during the month. Our cash holding has crept up by a small amount as we received another dividend, this time from LON:EQQQ. If you remember, when a company makes a profit, there are a number of things it can do. One of them is to pay some of it out to the shareholders who own the company and this is called a dividend.

*** Please Subscribe!

If you find our posts helpful in building a bright financial future then in exchange, please sign up to receive them by email. The more people that subscribe the more we grow which means we can create more content to help you become unimaginably wealthy. You can sign up using the subscribe box at the top of our website: https://thecrazyplan.com

*** Please Spread The Word!

This blog is free as we want everyone to have access to financial education. We hope to inspire you to set out on your own journey to a bright financial future and if we do, in return please spread the word to others.

NEXT MONTH

Next month we’re going to talk about inflation and what investing is. We have a very focused view on what investing should achieve and want to share it with you so that you can see why it’s so important to plan your financial future. If we don’t understand the whole concept of investing and what we’re trying to achieve then we’ll probably end up being tempted to spend or worse still, have to buy a tennis racket!

DISCLAIMER

Please note that by the time this blog is published, we may no longer own some or any of the investments discussed. Strategies and investments discussed might be totally unsuitable for you and we are not recommending them to you, they should only be considered as ideas for further research. You must read and agree to our Terms & Conditions, including the Disclaimer, which can be found on the T&C page of our website https://thecrazyplan.com

© TradeFloor Promotions Limited 2024